Why Is A Cap Table Audit Essential for Your Startup?

April 2, 2024

Cap table audits play a crucial role in ensuring the accuracy and transparency of a startup's ownership structure. These audits involve reviewing and verifying the company's capitalization table, which details the ownership stakes of founders, investors, employees, and other stakeholders. In this article, we will do a breakdown of cap table audits and the reasons for their importance forstartups.

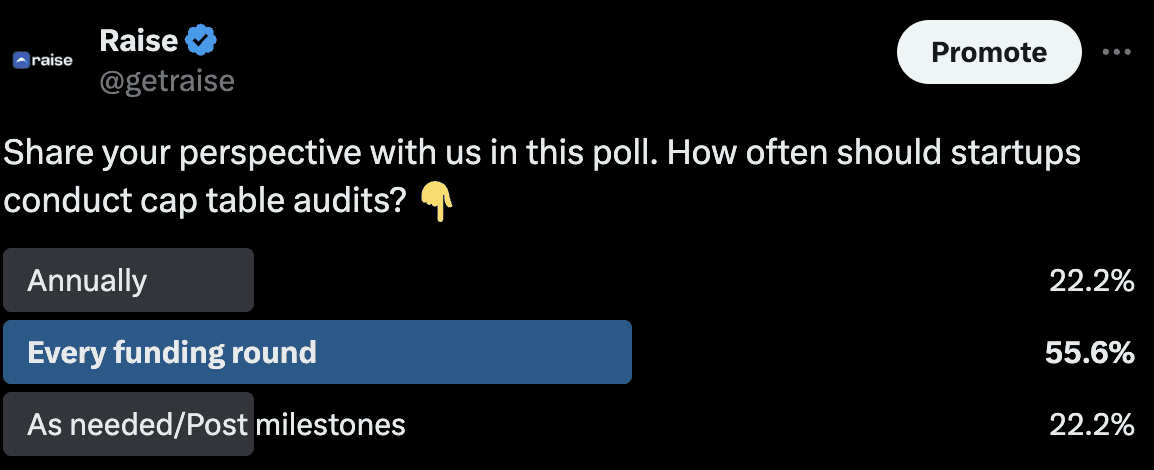

The primary goal of a cap table audit is to ensure compliance as well as check and rectify errors, inconsistencies and discrepancies existing on a cap table. In the table below, the results of a recent poll we conducted shed light on the frequency at which startups should conduct cap table audits.

Surprisingly, a majority of respondents, accounting for 55.6%, favored conducting audits with every funding round, emphasizing the importance of maintaining up-to-date and accurate records, especially during significant financial transactions. 22.2% of respondents suggested conducting audits annually, while another 22.2% advocated for audits on an as-needed basis or post-milestones. The consensus from the poll underscores the critical role of cap table audits in promoting transparency and trust within the startup ecosystem.

What is a Cap Table?

A capitalization table (cap table) is a document that showcases the ownership structure of a company. It gives an accurate overview of the equity ownership stakes, highlighting who owns what percentage of the company. Also, it helps founders, investors and company management to understand the effects of dilution, make better decisions and prepare for future scenarios such as mergers and acquisitions.

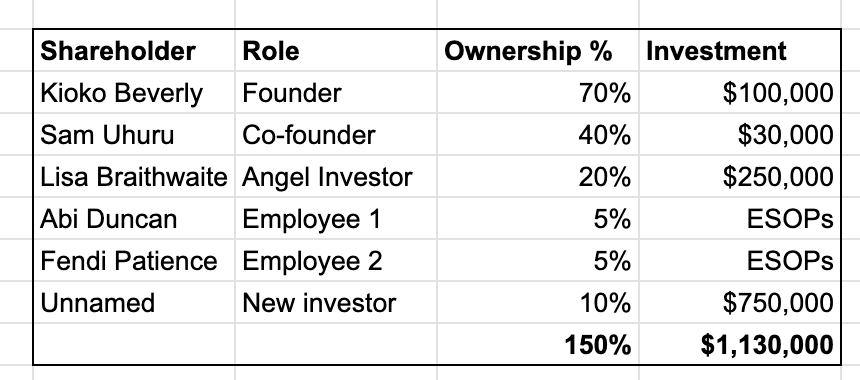

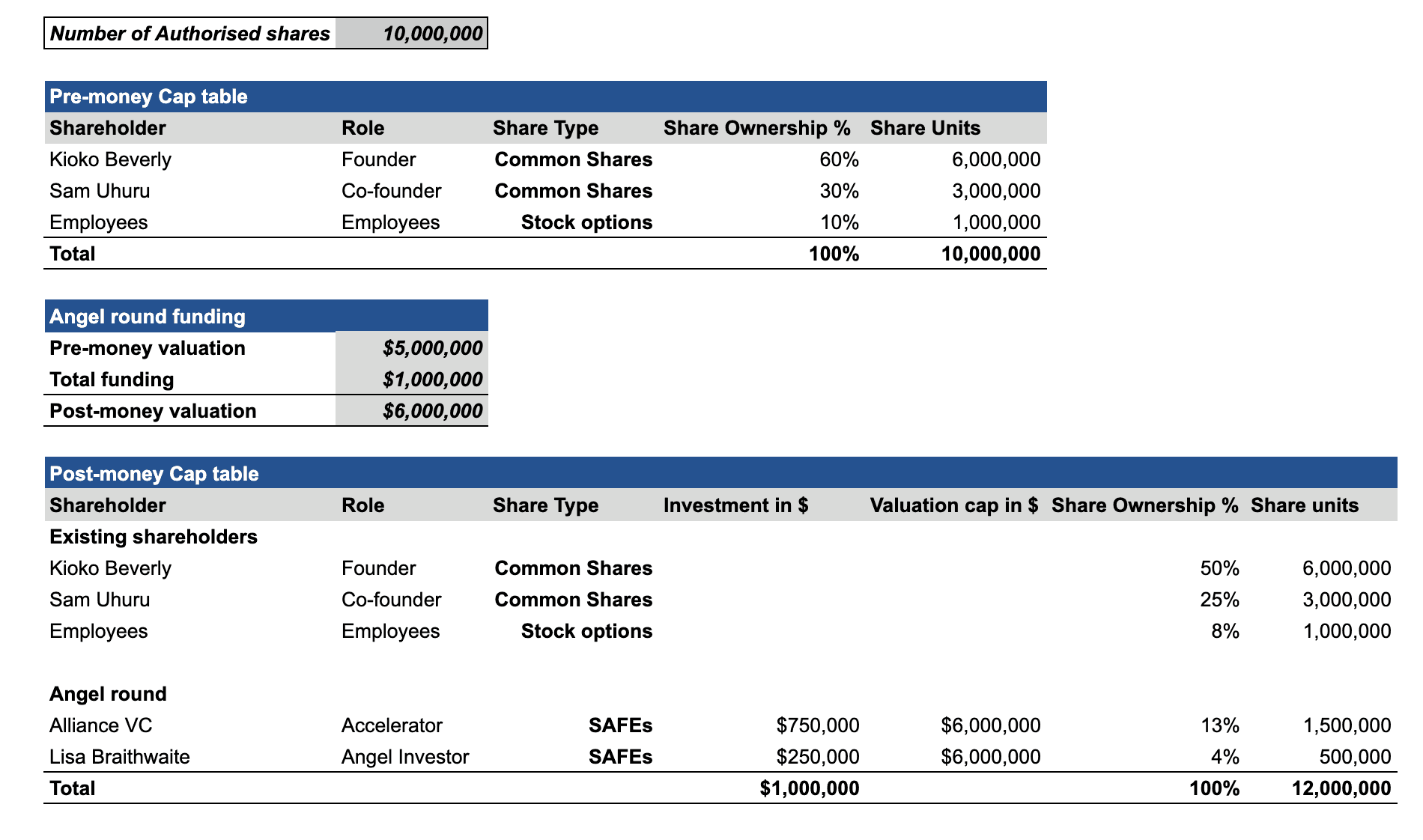

A disorganized cap table is messy and unclear, making it hard to understand who owns what in a company and keeping track of changes. On the other hand, an organized cap table is well-kept and structured, providing clear and accurate information about ownership percentages, investment rounds, and any equity-related transactions. Having an organized cap table helps with making decisions, communicating with investors, and going through due diligence smoothly, while a disorganized one can cause confusion, conflicts, and even legal problems.

Listen to a our Cap Table Makeover Twitter Space event where we discussed the essentials of cap tables and their importance.

Cap Table Audits

A cap table audit is a thorough review of the cap table to verify the content and ensure that it shows accurate and up-to-date information about the ownership distribution of the company. The audit is typically conducted by a team of financial and legal professionals whose roles involve reviewing and analysing data for accuracy and ensuring that the document is compliant with relevant laws and regulations of the market of operation. Regardless of the frequency at which the audit is done, cap table audits are typically conducted by legal and financial professionals to ensure compliance with regulatory requirements and to mitigate the risk of errors or discrepancies.

Why Cap Table Audits Are Essential

To ensure accuracy

With a cap table audit, you can clean up and prevent future errors on your cap table. A proper audit will involve checking for discrepancies in the document, cross-referencing numbers, percentages, dates, and other variables that can lead to issues for valuation or legal disputes in the future. A quality audit ensures that your cap table is accurate at a given time.

To prepare for investment rounds.

A clean and organized cap table is essential to prepare for investment rounds. It demonstrates preparedness, and professionalism and also instills confidence in investors. Through an audit, discrepancies can be eliminated to make fundraising rounds smoother hence laying a solid foundation for future rounds.

To stay compliant

A cap table audit enables companies to stay compliant with the regulatory requirements of their markets of operation. This ensures that startups adhere to the legal obligations of their market and prevents the companies from potential legal issues.

To make smarter decisions

A clear cap table structure is essential for decision-making. With an audit, startup operators and stakeholders can understand the impact of a future round on their ownership stake so that they make better decisions regarding fundraising and equity incentives.

To prepare for the future

Cap table audits also help streamline the processes for mergers, acquisitions and initial public offerings (IPO). A potential buyer will often want to scrutinize the existing cap table to know the company’s true worth and mitigate risks. An organized and properly audited cap table will help instil trust into the buyer.

The ultimate goal of a cap table audit is to assure the company stakeholders and market regulators that the ownership structure is properly documented, compliant, transparent and up to date.

Raise offers a Cap Table Audit service for Seed and Series A companies. With Raise's Cap Table Audit service, you will get a thorough audit of your company's existing cap table as well as expert guidance on how building a company and managing equity effectively. Plus detailed gap analysis report and personal assistance on fixing and optimize your corporate structure. Send us a message on WhatsApp to get started.