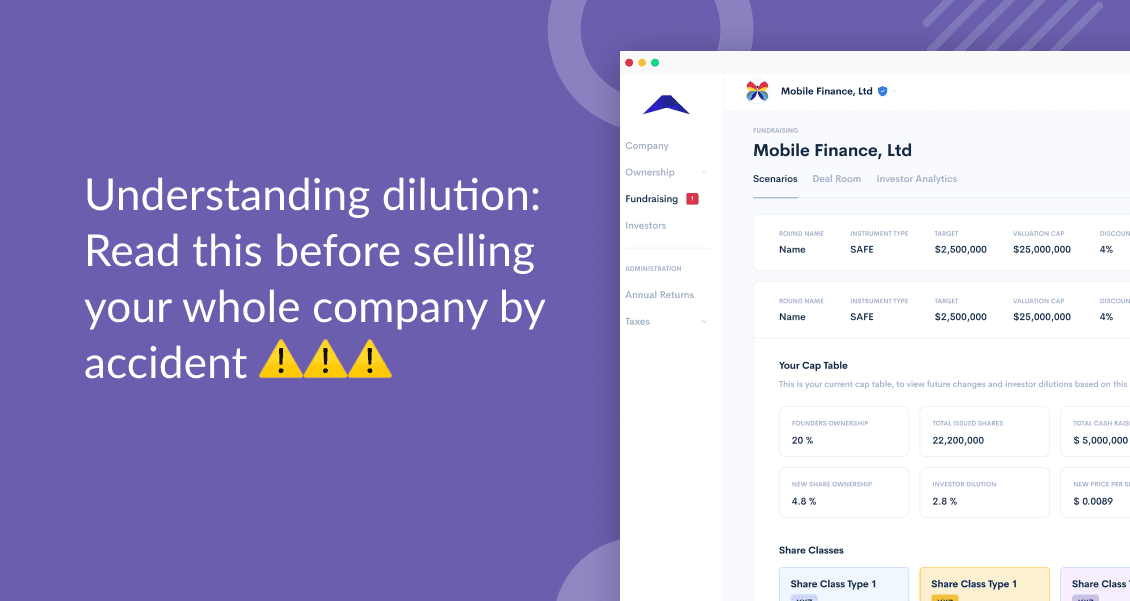

Understanding dilution for African founders

July 28, 2021

African founders, read this before selling your whole company by accident 🚨🚨🚨

We've worked with hundreds of founders across Africa. We've seen them accidentally sell off more of their company by accident. We're here to stop that from happening.

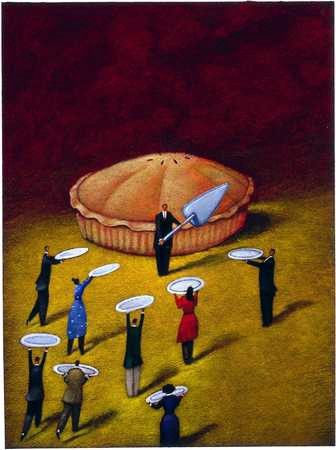

As you grow (because you’ve built a successful product and service), you’ll need to source funding from investors. Each of those investors will be buying shares in the company, meaning that the company will have to create shares to issue to them.

Every time your company creates more shares, the number of shares held by existing shareholders won’t usually change. What this means is that existing shareholders will own the same amount of shares in a company that just created more shares.

The existing shareholders are diluted, meaning that their percentage ownership of the company has decreased.

So, what is dilution, and how does it work?

Dilution is where a shareholder’s percentage ownership in a company decreases. What that means is you could go from owning 40% of a company to owning 32%. This usually happens when new shareholders are added to the company’s capitalization (cap table). New shareholders, well, they need to hold shares, right? The company will usually issue shares to those new shareholders and therefore need first to create those shares.

This could happen when you issue shares to investors, employees or new founders. But, how does this all work? How does the creation of shares dilute the existing shareholders?

Let’s look at an example to understand a bit better how dilution works.

Adebayo and Kabala are founders and owners of the Black Star Inc., a new startup on the block. Black Star at inception, created 1,000 shares, and Adebayo received 500, and Kabala received 500 of those. They are both each 50% owners in Black Star Inc.

One day, Nichole agrees to invest in Black Star. What she is doing is buying shares in Black Star. But, there are only 1,000 shares currently available in Black Star, and Adebayo and Kabala hold all of those shares. There aren’t enough shares for Nichole to buy. What Black Star Inc. needs to do then, is create more shares to issue to Nichole.

Black Star creates 500 more shares, bringing the total amount of shares issued by Black Star to 1,500 (1,000 shares originally issued + 500 shares for Nichole = 1,500 shares total). There are now 1,500 shares issued by Black Star, and Nichole owns 500 of them.

The result? Both Adebayo and Kabala still own 500 shares each, but now, instead of holding 50% of Black Star, they now own 33% along with Nichole:

Total Shares: 1,500

Adebayo: 500 — [33%]

Kabala: 500 — [33%]

Nichole: 500 — [33%]

Adebayo and Kabala previously owned 50% of the Black Star each. But as the company created more shares, their number of shares did not change (it stayed at 500 shares each). Each of them has been diluted because they went from owning 50% to now owning 33% of Black Star.

This happened because the company created more shares, and the share percentage is calculated over the total number of shares issued. When that total number of shares increases, your ownership percentage will usually decrease.

There’s nothing to be scared of — dilution is just a necessary part of growth.

There are many things you can do to prepare and calculate dilution ahead of time. Of course, we’ll post about that in the future.

Do employee stock options convertible notes cause dilution?

Convertible notes only dilute share ownership when they convert. Until then, they remain as convertible notes (debts, simple agreements for future equity), and only dilute share ownership on the agreed date that they become shares. See more about convertibles in a previous article we’ve posted.

Employees stock options can also dilute shares. Investors are mindful of companies that grant employees a large percentage of option pool securities (read about option pools on our previous blog post). When employees choose to exercise their options, the common shares will be diluted.

#RaiseTip

Dilution can reduce the value of your investment, however, the upside is that it serves a purpose in growing your company so that your equity’s value can grow too. It’s better to have 1% of something that has 100% of nothing.

Until the next post! #keepbuilding.

DISCLOSURE: This communication is on behalf of Raise Impact Technologies Inc. (“Raise”). This communication is not to be construed as legal, financial or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Raise does not assume any liability for reliance on the information provided herein.