Raising money in Africa with term sheets

July 28, 2021

The art of the term sheet 📊

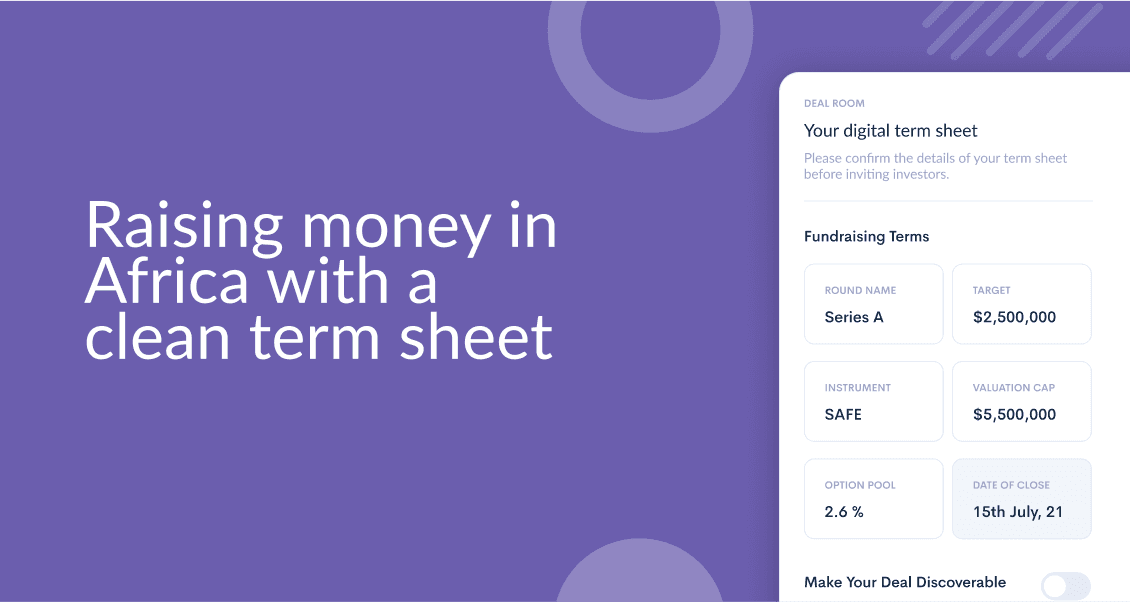

If you’re reading this, you’re likely raising capital, with a clear understanding of how much you need to raise and the percentage of the company you’re selling to investors. There’s a single 3–5 page non-binding document you can create to communicate that offer transparently to potential investors.

That document is called a term sheet.

What is a term sheet?

It summarizes your company’s offer for investment.

Drafting your own term sheet shows your potential investors that you’re serious about closing your funding round and building your company.

A term sheet provides clarity for both yourself and your investors to understand the terms that you are offering. It forms a strong foundation to continue negotiating.

Good news! You can draft a simple term sheet in three simple steps.

Drafting your sheet in 3 steps

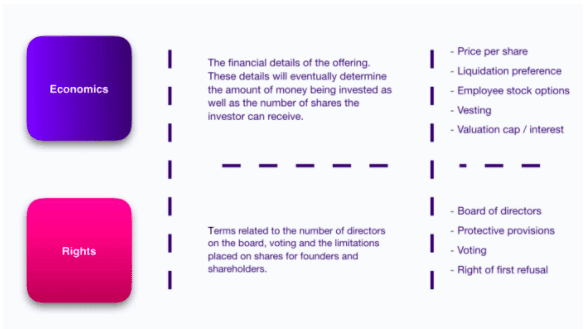

Your first step is to understand the basic components of a well-drafted term sheet: (1) financial terms and (2) rights and governance.

Your second step is to download and edit a good template. But wait! Before you leave this tab to google a template, keep reading. There are thousands of templates online, and their quality can vary drastically. Luckily, our team created a folder for you of curated templates that you can access here.

Your third step is to edit the highlighted sections of the template to tailor the term sheet to your offer details. Whether you’re offering convertibles like simple agreements for future equity or shares, the different templates have highlighted sections to edit information about financial terms, rights, and corporate governance.

Next, send the term sheet to potential investors and continue negotiating your funding round. Once you and your investors agree on the details in the term sheet, you can move on to draft a full contract and close the deal.

When creating and negotiating your term sheet, be transparent, and make sure that your objectives are all aligned. Always remember to consider your company’s motives and goals, as well as your investors’.

#raisetip

It is important to note that term sheets are usually not binding. Ultimately they act as a summary of the terms that will be drafted by lawyers in order to close the financing round.

Until the next post! #keepbuilding

DISCLOSURE: This communication is on behalf of Raise Impact Technologies Inc., (“Raise”). This communication is not to be construed as legal, financial or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Raise does not assume any liability for reliance on the information provided herein.