Raising money in Africa with SAFEs and Convertible Notes

July 21, 2021

We wrote this article three times before we published it 😪

That’s because securities and fundraising get complicated very quickly.

Sometimes (but usually all the time), fundraising is tricky — and founders and their investors need to understand what they’re getting into when they sign a deal to invest and build the next best product.

Convertible notes are actually pretty simple to understand. They’re hard to get right. And to explain, we thought we’d tell a story that we see very often.

You’re a startup with the next best thing. To build that next big thing, you need cash to hire a team and get it going. So you start offering to sell a percentage of your company to investors you meet at tech or other conferences.

Every investor you speak to will tell you something like, “I like your company, but you’re too early-stage for me to invest in now” (don’t let that hurt your hustle — they’re probably right).

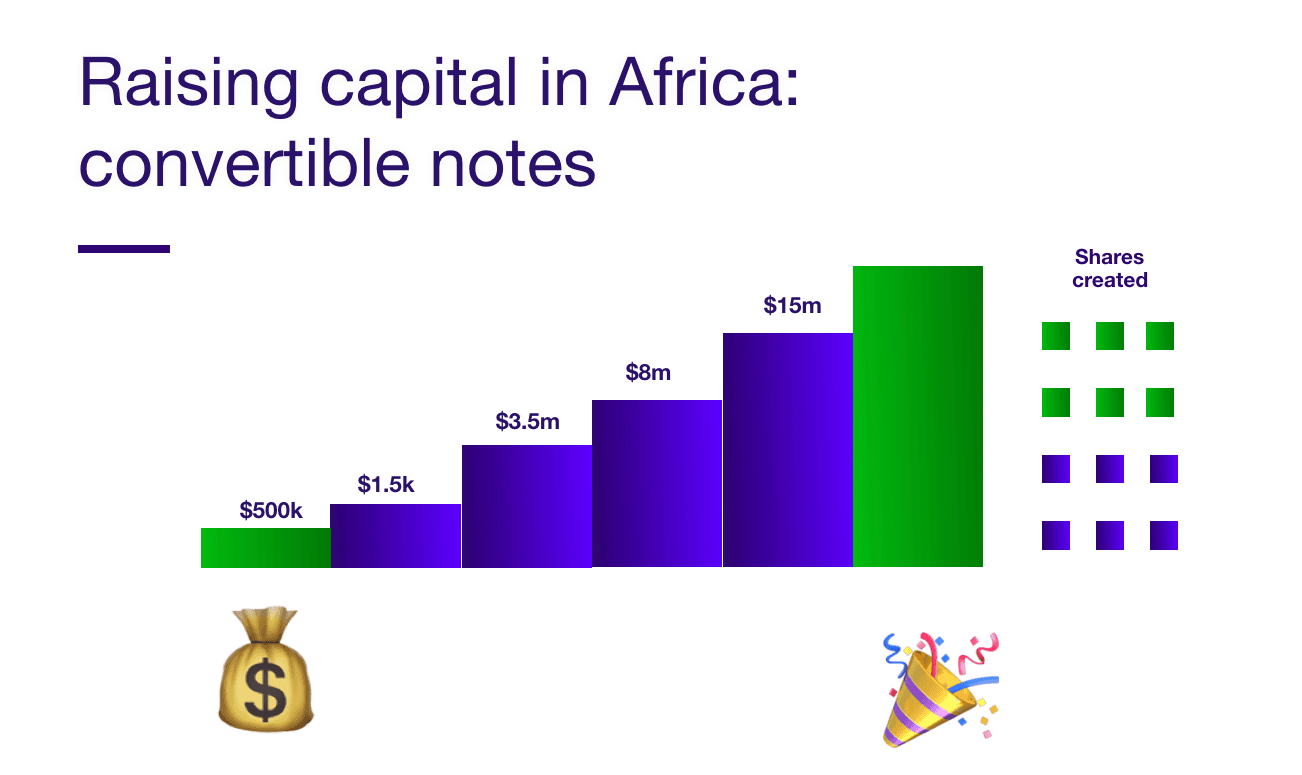

You can’t sell shares without giving them a price, and you can’t set a price per share without a valuation for the company. You’ll usually set a price for those shares in your seed round, but to get to a seed round financing, you need tons of traction, the next best product and a great team.

You’re stuck until you find out about convertible notes. Convertible notes are an easy way for your startup to raise capital without having to create value for the shares. So, you jump online, read one or two TechCrunch articles about the pros and cons of convertible notes like simple agreements for future equity, find the YC template, and raise $300,000 by selling Simple Agreement for Future Equity to your three convertible-holding investors.

(please don’t go to that YC link just yet! we’re in the middle of a stimulating story)

Good job, superstar! Now, you can build the next best thing. You build it, and one day you raise your seed round.

On that day, all of the SAFEs you sold to raise $300,000 will now magically turn (or convert)into shares. Those three investors are now shareholders. Makes sense, right?

Sure, just one problem. You didn’t test the mathematical calculations in that TechCrunch article. Those calculations are necessary because they determine how much percentage of the company the $300,000 will buy for those convertible-holding investors. But hold on, we’re not quite done.

You’re also selling shares to the new investors in the seed round. Yes, you guessed it. You’re issuing shares to both the convertible holders and the new investors.

If you’ve already issued convertible notes, you’re also guessing right. When those notes trigger — there’s a high chance that you will have sold a much bigger percentage of your company than you thought.

🚧 Convertible notes can be tricky and cause unexpected consequences to both founders and their investors

We see it so often that we’re going to need to start a series dedicated to explaining convertible notes in the future. For now, we’ll start easy with the most straightforward part of convertibles. They’re all work the same, with two significant elements in common in the early-stage technology financing world: terms and triggers.

Terms

The terms of a convertible note are used to determine something simple: the percentage ownership that the convertible-holding investor will get when the notes are triggered and turn into shares. Terms are usually buried in deep legal jargon and mathematical calculations. Be careful.

Triggers

Convertible notes are triggered — and turn into shares with equal percentage ownership in your company. It’s simple — on the day the trigger happens — the $300,000 you issued in SAFEs will become 20% of the company.

What’s next

There’s a lot to unpack about convertible notes — there are different kinds, terms and strategies to use them. So, we’ll be writing more posts about them in the future to guide both founders and their investors in the future.

Our objective is for you to pull up a convertible note template, edit it, and confidently sell it to investors to raise capital and grow your product.

Until the next post! #keepbuilding

DISCLOSURE: This communication is on behalf of Raise Impact Technologies Inc. (“Raise”). This communication is not to be construed as legal, financial or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Raise does not assume any liability for reliance on the information provided herein.