How to navigate the 2023 funding landscape and prepare for your next round.

October 9, 2023

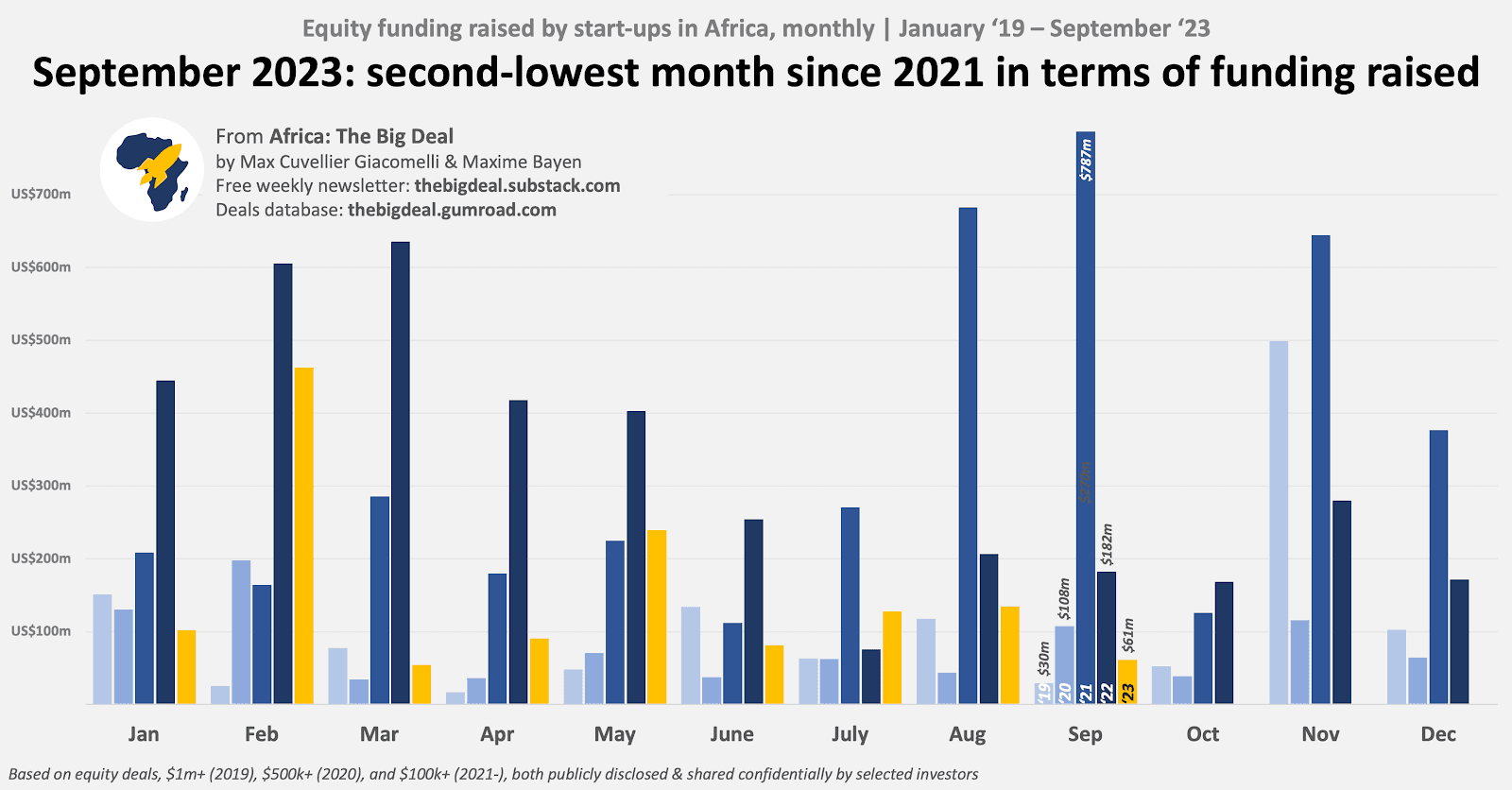

In the dynamic world of startups, the availability of funding plays a critical role in determining the pace and trajectory of growth. Recently, Africa: The Big Deal highlighted a significant challenge in the funding landscape for African startups, particularly in September 2023, making it the second-lowest month for funding this year. However, even in the face of this funding dip, there were encouraging signs of resilience and potential growth within the startup ecosystem.

Key highlights:

Total funding was notably driven by three transactions, making up 58% of the raised funds.

Wetility (South Africa), SunCulture, and Lupiya (Zambia) secured significant funding.

Notably, no exits were reported, but the closure of 54gene was confirmed.

Despite the dip, investors remain engaged in the African startup landscape, evidenced by recent fund closures and ongoing fundraising efforts.

In summary:

Startups in Africa raised $1.4b in equity funding in the first nine months of 2023, showcasing resilience amid challenges.

While 2023 numbers track below previous years, notable fund closings and ongoing fundraising activities are promising signs for the future.

This shift underscores the importance for African startups to strategize and adapt effectively, below are some insights to help you refine your fundraising approaches and improve your chances of success.

1. Approach to Funding: Diversification and Resilience

Diversifying funding sources is paramount to ensure financial stability and resilience for startups. Relying solely on traditional equity funding may not be the optimal approach. Exploring alternative funding avenues such as grants, debt financing, or impact investment can be instrumental in tackling economic fluctuations. Furthermore, you should fine-tune your pitch presentations, align them with current market dynamics and showcase robust business models. Demonstrating the social impact of your venture and emphasizing innovation and scalability can significantly enhance your attractiveness to potential investors.

2. Investor Confidence: Engaging and Demonstrating Value

Despite the funding challenge, recent fund closures and ongoing fundraising efforts show the unwavering confidence investors have in the potential of African startups. Building and nurturing investor relationships is key. Engaging with investors regularly, updating them on your progress, and clearly articulating your value propositions can help sustain this confidence. Convincing investors of the viability and growth prospects of your venture is pivotal in attracting the necessary funding.

3. Milestones and Exits: Key to Attracting Larger Investments

Striving for significant milestones and successful exits can be a game-changer in attracting larger investments. Investors are keen on startups that demonstrate clear progress, whether it's reaching a certain user base, achieving revenue targets, or expanding into new markets. Successful exits from previous ventures reflect positively on the entrepreneurial team and instill confidence in prospective investors.

4. Collaboration and Support: Strengthening the Ecosystem

Collaboration is the cornerstone of a thriving startup ecosystem. Establishing partnerships with stakeholders, including investors, accelerators, industry peers, and governmental organizations, can offer a multitude of benefits. Such collaborations can provide you with valuable insights, mentorship, access to networks, and even funding opportunities. Working collectively towards a common goal can significantly contribute to overcoming funding challenges.

5. Sustainability: The Path to Long-term Value

Prioritizing sustainable growth models is crucial for attracting investors seeking long-term value. Investors are increasingly interested in startups that focus on sustainability, responsible practices, and long-term profitability. A sustainable approach not only aligns with global trends but also positions the startup favorably in the eyes of impact investors and stakeholders.

While the funding landscape may present challenges, it also offers opportunities for innovation and growth. As an African startup, using these insights and adapt your strategies to navigate the ever-evolving funding landscape is the key to position your company for success and secure the funding needed to realize your vision.

If you need more support in refining your strategic approach as you prepare for your next fundraising round, you can reach out to us to help you plan and get investor-ready. Book a call with us today.