How ESOPs Can Motivate Your Team

June 7, 2024

As your startup grows, the promise of future liquidity becomes more real. Imagine your startup reaching a point where it's attractive enough to be acquired or go public. Such events bring significant financial gains, not only for founders and investors but also for employees who have been part of the journey. Achieving this future liquidity is not just about having a great product or service; it's about building a committed and motivated team that drives the company forward. This is where Employee Stock Ownership Plans (ESOPs) come into play.

Understanding ESOPs

ESOPs are a type of employee benefit plan that gives workers ownership interest in the company. They are stock options granted to employees, which they can exercise to buy shares of the company at a set price. Typically, these options vest over a period, meaning employees earn the right to buy these shares incrementally over time as they continue to work with the company.

How ESOPs Work

Granting Options: Employees are granted stock options as part of their compensation package.

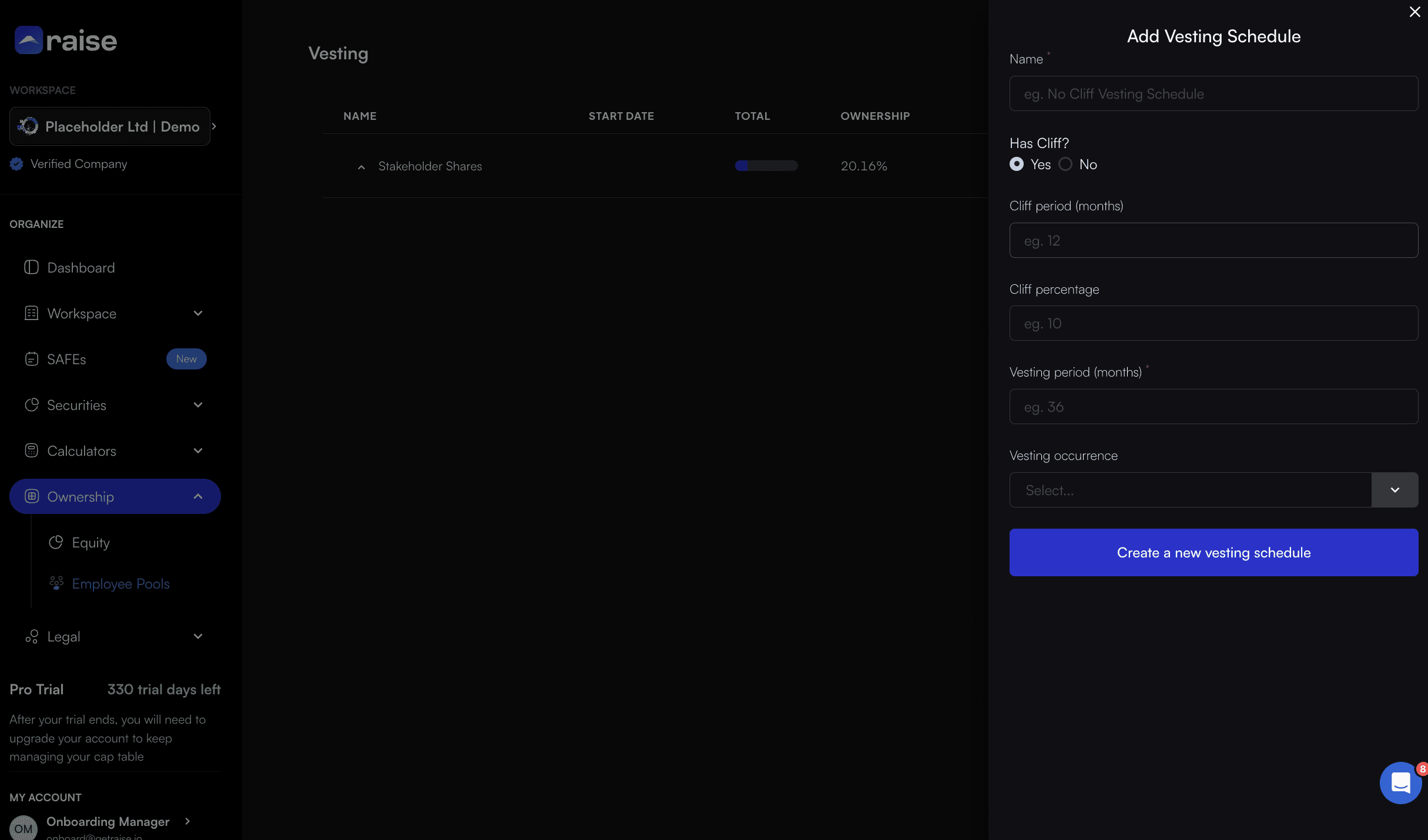

Vesting Period: These options vest over a specific period, encouraging employees to stay with the company longer.

Exercise of Options: Once the options vest, employees can exercise them, meaning they can buy shares at the predetermined price.

Sale of Shares: When the company reaches liquidity (like an IPO or acquisition), employees can sell their shares, often at a much higher price than they purchased them.

How ESOPs Motivate and Retain Talent

For African startups, where access to capital and talent can be challenging, ESOPs are a strategic tool. They not only help in retaining key employees but also in attracting talent who might otherwise seek opportunities in more established markets. Additionally, as African startups increasingly attract global attention and investment, having an ESOP plan in place can make your company more appealing to international investors looking for well-structured and incentivized teams.

Ownership & Innovation: ESOPs turn employees into stakeholders. When employees have ownership in the company, they care more about its success. They are more likely to contribute innovative ideas and solutions that can drive the company forward. This culture of innovation can give your startup a competitive edge in the market. Also, they think about the long-term impact of their actions and make decisions that benefit the company and this fosters a culture of accountability and responsibility.

Long-term Commitment: The vesting period of ESOPs ensures that employees are invested in the company's future. They are motivated to stay with the company longer to see their stock options vest. This reduces turnover and ensures that the company retains valuable knowledge and skills. Employees who feel they have a stake in the company are more likely to stay during tough times, providing stability to the organization.

Attracting Top Talent: Offering stock options can be a significant draw for top talent. Many potential employees are looking for more than just a paycheck; they want to be part of something bigger and share in the success they help create. ESOPs can make your company more attractive to top talent who are looking for opportunities to grow with the company and benefit from its success.

Boosting Morale and Productivity: Knowing that their hard work could lead to substantial financial rewards can boost employee morale and productivity. When employees feel valued and see a direct link between their efforts and the company's success, they are likely to be more engaged and productive. This sense of ownership and potential for financial gain can drive employees to go the extra mile and contribute to the company's growth.

Creating a Legacy: For many African founders, creating a lasting legacy is important. ESOPs can help in achieving this by ensuring that the employees who have contributed to the company's success share in its rewards. This not only creates a sense of loyalty and pride among employees but also ensures that the company continues to thrive even after the founder steps down.

By implementing a well-structured ESOP plan, you can ensure that your employees are motivated, loyal, and aligned with the company's goals. This alignment is crucial for driving the company toward future liquidity events, where everyone stands to gain.

Raise specializes in equity management and can help you plan and implement effective ESOPs tailored to your specific needs. We understand the unique challenges and opportunities in the African startup ecosystem and are here to support you in building a motivated and high-performing team.

Start planning your ESOP today and take the first step towards a brighter, more successful future for your startup and your team. Get in touch with the team directly. We are also available on WhatsApp here.