From Startup to Exit: Understanding IPOs and M&As for Liquidity

July 11, 2024

You’ve probably been thinking a lot about your startup's future and how you'll eventually get liquidity for all your hard work. What should you be planning for?

Liquidity is all about being able to turn your equity in the startup into cash. It's important to think about this from the very beginning because it impacts how you grow and structure your business. Planning for liquidity helps you set clear goals and strategies. It makes you think about your endgame: Are you aiming to get acquired by a larger company, or do you see your startup going public with an Initial Public Offering (IPO)? Each path has its own requirements and steps.

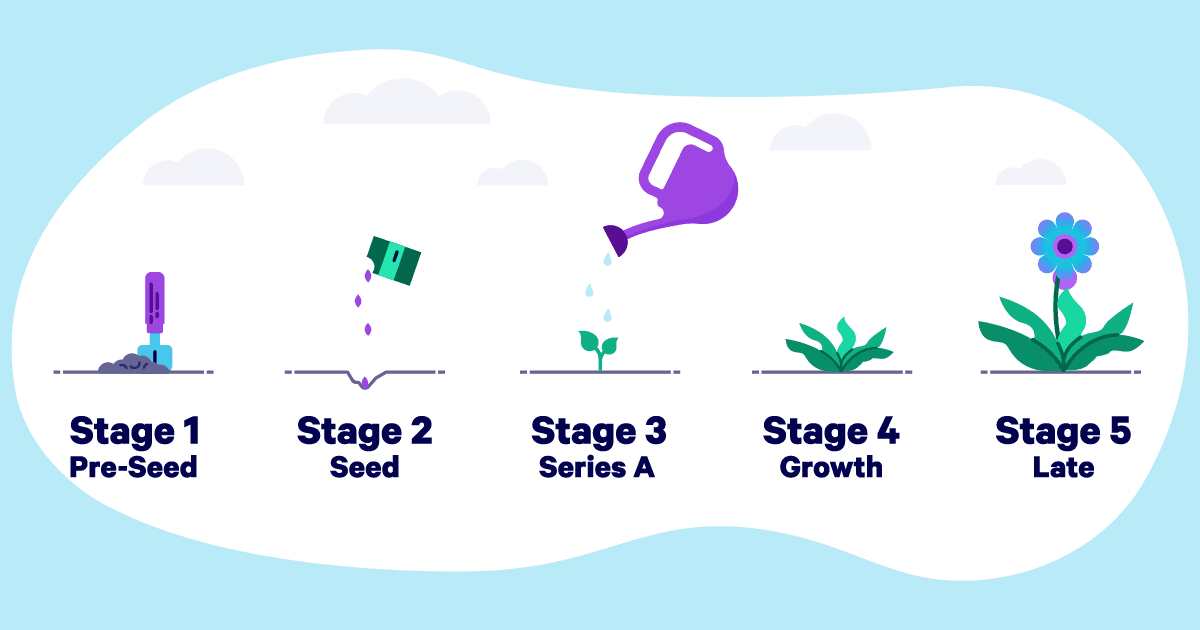

Startups usually go through several stages:

Pre-seed stage: The initial phase where you develop an idea and seek initial funding, often from personal savings or early supporters.

Seed Stage: The phase where the business concept is validated, and initial funds are raised from friends, family, or angel investors to build a minimum viable product (MVP).

Series A Stage: The stage where the startup has a product and market fit, raising significant venture capital to scale operations and grow the customer base.

Growth Stage: The phase where the startup experiences rapid expansion, often through multiple funding rounds, focusing on scaling the business and increasing market share.

Late Stage: The stage where the startup prepares for an exit, such as an IPO or acquisition, focusing on maximizing valuation and solidifying its market position.

How do IPOs and M&As help with liquidity?

An IPO, is when your company goes public by offering shares for sale to the general public on a stock exchange. This allows you to raise a lot of capital and gives your investors a chance to sell their shares.

On the other hand, an M&A (Mergers and Acquisitions) is when your company is bought by another company. This can happen in two ways: a merger, where two companies combine to form a new entity, or an acquisition, where a larger company buys your startup.

Both IPOs and M&As provide significant liquidity. With an IPO, your shares become publicly traded, meaning you and your investors can sell them on the open market. This can be a huge payday if your company is valued highly. With an M&A, the acquiring company usually pays in cash, stock, or a combination of both. This means you and your investors get a direct financial return from the sale.

It depends on your company's situation and goals. An IPO can raise a lot of capital and keep your business independent, but it's also complex and expensive. You'll need to comply with strict regulations and be prepared for public scrutiny. An M&A can be quicker and simpler, and it might be the best option if a larger company can integrate your product or team effectively. However, you might lose some control over your business post-acquisition.

What are the potential benefits of these liquidity events?

Return on investment: crucial for investors if you’ve raised a lot of capital. They also reward the founders and early employees who have equity in the company. Plus, having liquidity means you can reinvest in new ventures or expand your business further.

Boost reputation: a successful IPO or M&A can boost your reputation and credibility, making it easier to attract top talent and more investment in the future.

There are definitely downsides to both. An IPO involves ongoing costs and regulatory requirements. You’ll need to focus a lot on investor relations and quarterly earnings reports, which can be a distraction from running the business. For M&As, the biggest risk is cultural integration. If the acquiring company has a different culture or vision, it can lead to conflicts and disrupt the business.

Preparing for liquidity events

Start by building a strong business foundation. Focus on achieving solid financial performance and a scalable business model. Maintain good relationships with potential investors and partners. It’s also wise to have a clear exit strategy and to keep your finances and operations transparent.

Also, surround yourself with experienced advisors and legal counsel. They can guide you through the complexities of both IPOs and M&As, ensuring you make informed decisions.

With the right planning and execution, IPOs and M&As can be fantastic opportunities for liquidity and growth. Keep building your business with these goals in mind, and you'll be well-prepared for the future. The best path to liquidity might change as your company grows and the market evolves. Always be ready to adapt your strategy accordingly.