Equity Ownership for Long-term Capital Market Vitality in Africa

May 27, 2024

Advanced economies rely heavily on equity ownership and capital vitality. It’s what forms the financial backbone of corporations and lets people share in business profits, helps boost economic growth and improves social prosperity in the society. The United States, China, and India offer valuable lessons in developing vibrant equity markets.

In the United States, for instance, there's a mature, highly liquid, and transparent equity market with broad participation from individual and institutional investors, which has fueled innovation and economic stability. Meanwhile, China's rapid market growth has been driven by strategic government reforms aimed at enhancing efficiency and attracting foreign investment, crucial for its economic transformation and infrastructure development. Similarly, India's equity markets have experienced significant growth due to gradual economic liberalization and regulatory improvements, which have increased market depth and liquidity through greater participation from retail investors and mutual funds.

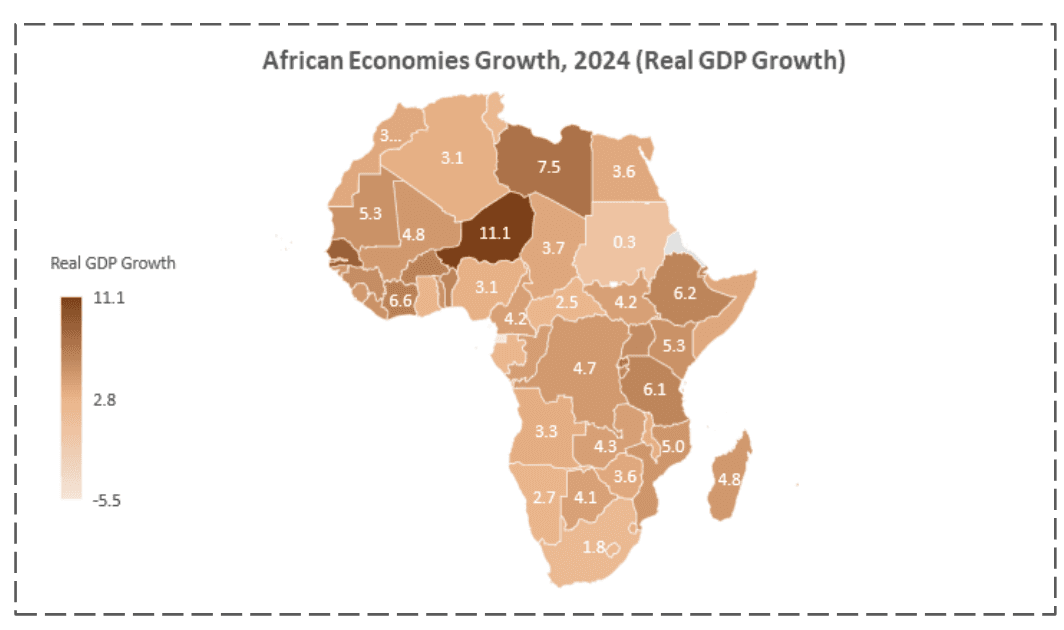

Compared to other markets, Africa is uniquely different, contending with macroeconomic challenges that has hindered business activity and economic growth. In 2023 alone, the African market had to deal with inflation and global interest rate hikes, reduction in export-oriented sectors, a global economic slowdown, exchange rate pressures, and limited fiscal strength. Although even with these obstacles, African economies still show some remarkable resilience. However, despite these hurdles, there's a bright spot in Africa's economic landscape: its potential for equity ownership.

African capital markets tends to face challenges in achieving sufficient liquidity, particularly after business exits. While these other market experiences offer valuable insights, we need to address the unique challenges and seize opportunities to develop robust equity markets, boost capital vitality to ensure sustainable economic growth and prosperity for Africans.

Equity Ownership vs Capital Vitality

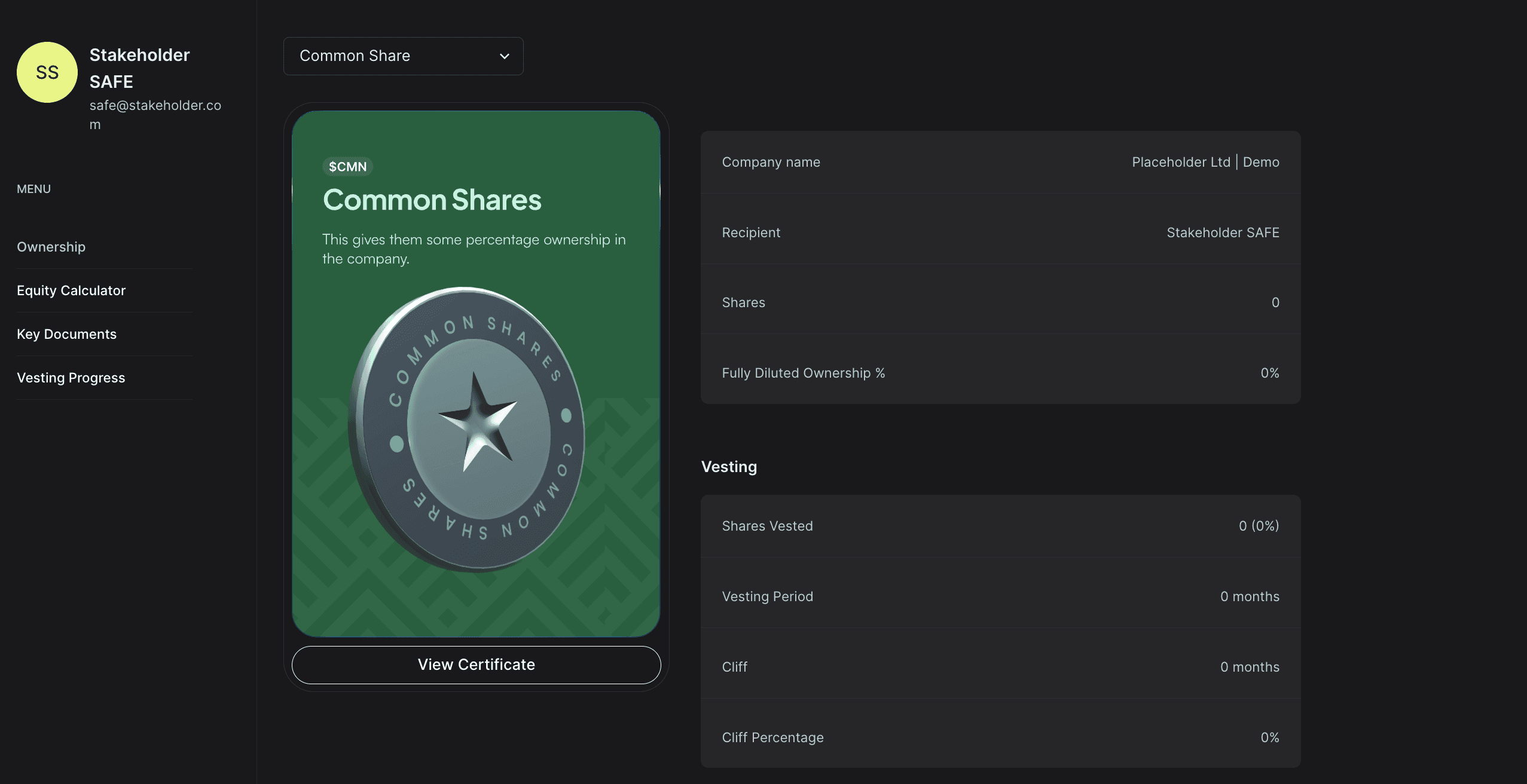

Equity ownership means holding shares in a company, making you a part-owner entitled to a share of the profits, usually as dividends. It also gives you rights like voting on key issues and electing the board of directors. There are two types: common shares, which come with voting rights but are last to claim assets if the company liquidates, and preferred shares, which usually don't have voting rights but have a higher claim on assets and fixed dividends.

On the other hand, Capital vitality means having a healthy financial system that works well. It's about how easily money can move around, how clear and fair the rules are, and the different ways people can invest their money. Keeping the financial system active with capital vitality relies on several essential factors that work collectively: Liquidity, Transparency, Regulation & Different Financial instruments

Liquidity is vital; how easily assets can be traded without affecting their prices. High liquidity in equity markets encourages more people to invest because they can easily buy and sell. Transparency is also key, ensuring that information about market conditions, how companies are doing, and the overall economy is clear and easy to understand. This helps investors make smart choices about where to put their money. Effective regulation sets rules to prevent fraud, protect investors, and keep the market stable. Lastly, having lots of different types of investments available is helpful because it lets people choose what's right for them based on how much risk they're comfortable with and what they want to achieve financially.

Equity ownership and capital vitality go hand in hand, boosting each other to drive economic success. Strong capital markets support equity ownership by providing the foundation for trading shares and raising money. At the same time, having lots of people owning shares helps keep the market strong and growing by bringing in more diverse investors, making the market more stable and able to bounce back from challenges. Equity markets help companies grow by letting them raise money through selling shares. This process fuels expansion, innovation, and job creation. Also, when more people own shares, it spreads wealth more evenly, reducing economic inequality and promoting fair growth. Active shareholders push for decisions that benefit the company in the long run, improving how businesses are managed. Having many different investors keeps the market steady, preventing big swings in prices and boosting confidence.

In general, while equity ownership is about owning shares in a company for potential success, capital vitality is about having a strong financial system that efficiently uses resources, encourages innovation, and boosts economic growth. When the financial system is strong, it helps businesses grow and encourages people to invest, which is good for everyone. Together, equity ownership and capital vitality support long-lasting economic growth and prosperity.

The problem in the African Market

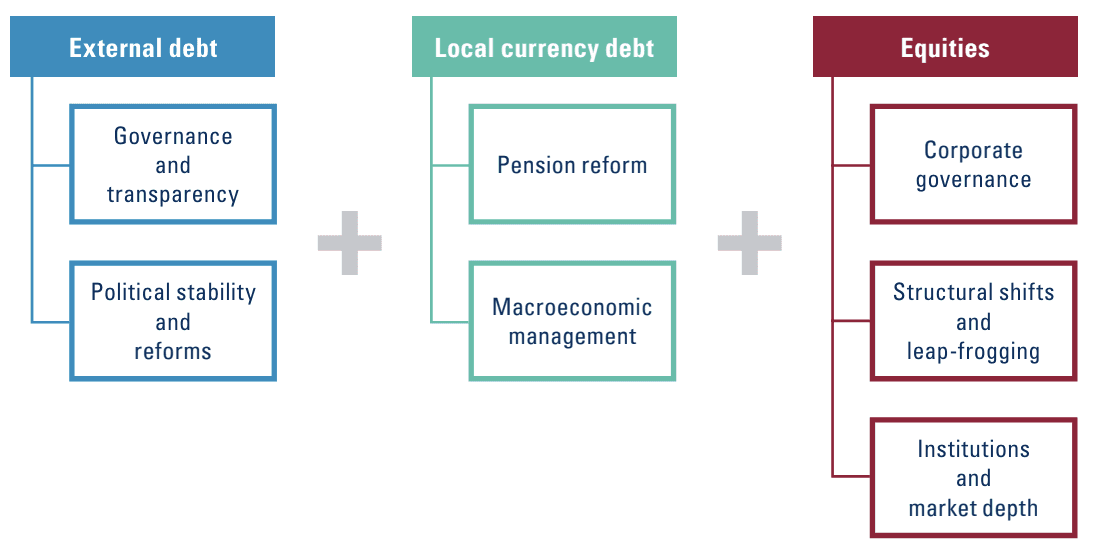

African capital markets are not currently as transparent as they can be and this is a crucial need to facilitate liquidity within the continent. How do we improve on current standards so that there can be a more conducive environment for equity trading? How can we pull in both local and foreign investors to the market especially starting with the startup ecosystem?

A key challenge in the African market is the limited understanding and appreciation of equity ownership among entrepreneurs, investors, and the general population. We have a market where many founders and operators prioritize debt financing or prefer to retain full ownership of their businesses, overlooking the potential benefits of equity financing. In short, most founders don’t really understand how owning stocks can be beneficial in the long-term.

We need to reorient that approach and build an entrepreneurial culture that successful exits can become the norm. We need to start restructuring businesses that can attract patient investors and be poised for future liquidity events. Our businesses need to be able to showcase quality potential returns to investors, a diverse set of equity investment benefits so that we can have an increase in demand for equity securities in the market.

What’s Next?

Equity ownership is crucial for long-term growth in Africa's financial markets. We can learn from more advanced markets and use our challenges as opportunities to improve our systems. We need to encourage a culture where selling shares and successful exits are seen as normal. Businesses should be set up to attract investors who are patient and ready for future opportunities. By showing the benefits of investing in stocks and making our markets easier to access, we can create a fairer and more open financial system that benefits everyone.

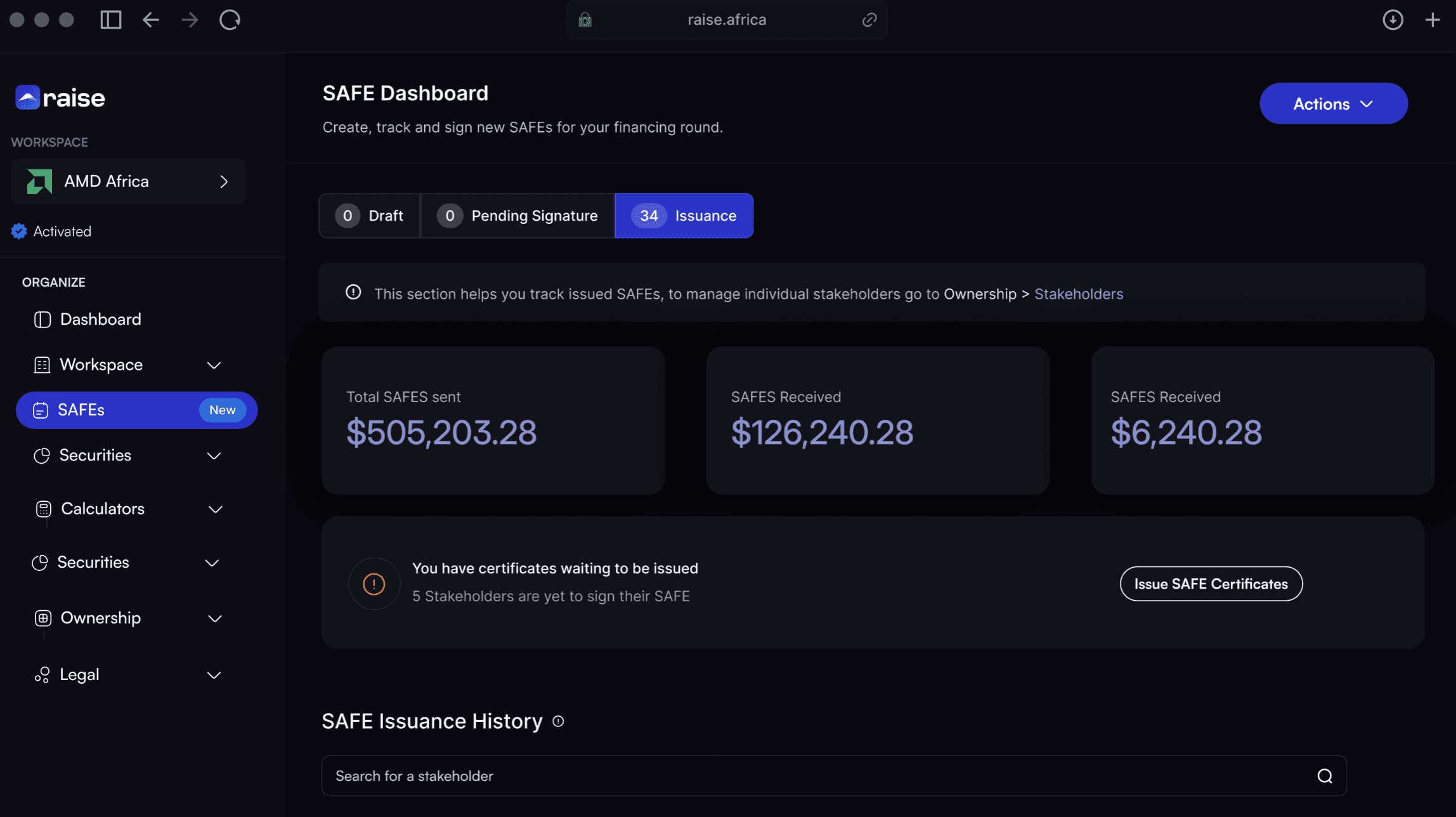

Additionally, digital innovations, such as improving upon equity management tools, like Raise, can play a significant role in this transformation. We’ve built custom tools that can help founders, operators and investors manage their shares more efficiently, track investor relations, and streamline the process of issuing new equity.

For example, we launched a stakeholder wallet feature recently to help shareholders track their ownership in real-time. Tools like Raise alongside other solutions are poised to help African companies can better engage with investors, improve transparency, and enhance market liquidity. This digital shift can make it easier for businesses to navigate the complexities of equity ownership and attract a wider pool of investors.

The Equity Wallet on Raise serves as a central hub for equity holdings and allows users to track all their equity holdings effortlessly, providing a clear ownership structure for investor discussions. It enables the simulation of various liquidity event outcomes, adjusting valuations and terms for strategic planning. Automated equity management tools streamline investor communications and legal paperwork, saving time and reducing errors, while ensuring up-to-date information on equity holdings and ownership structure.

Lastly, we need strong rules and support from governments. We need policies that help investors, both local and foreign, feel confident in putting their money into African businesses. By working together to educate people about stocks and making our markets transparent, continue innovating with digital solutions and a tailored support from the government we can build a better financial future and make our financial system more fair and open to everyone.

If you’re ready to start organizing for future liquidity, explore the equity wallets on app.raise.africa or get in touch with the team directly here. We are also available on WhatsApp here.