Equity Management for Liquidity & Generational Wealth [Part 1]

May 8, 2024

When you start a business in Africa, you'll find an environment rich with entrepreneurship and digital opportunities. But launching a tech-enabled startup here comes with its share of hurdles. You'll need to navigate bureaucratic hurdles and overcome infrastructure challenges along the way.

Tech startups, particularly in fintech, have experienced notable growth, drawing interest from both local and international investors. In countries like Nigeria, Kenya, and South Africa, you'll encounter competitive environments for startups, with fintech leading in funding and other sectors not far behind.

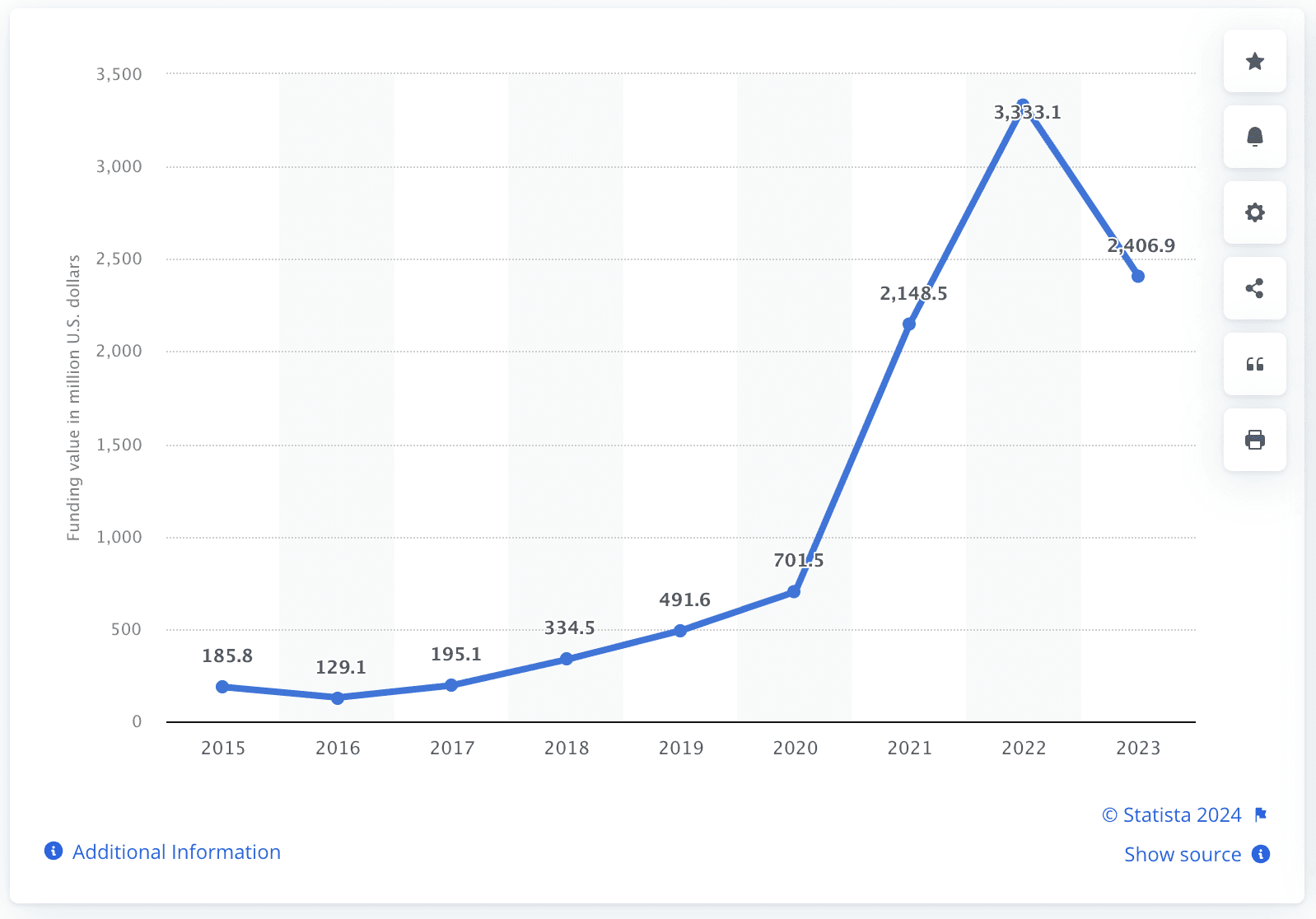

In 2021 alone, we witnessed a remarkable surge in funding for African fintech startups, skyrocketing from $55 million in 2015 to over $1 billion. Fintech dominated the investment landscape for African tech businesses that year. The continent's appeal to investors is growing, evidenced by the rising number of venture capital deals and the emergence of unicorns. These trends signal a promising future for African startups, capturing attention and interest in potential opportunities. Although recent downward spiral in funding has affected the startup ecosystem.

Equity Management in African Startups

If you're considering starting a business in Africa, you're aiming to tackle important societal issues while also contributing to economic development.

As a startup founder, you have the potential to drive growth, generate employment, and spur innovation throughout the continent. Your role is crucial in bolstering the economy by creating jobs, generating tax revenue, and attracting foreign investments. Moreover, startups contribute to diversifying the economy by operating in various sectors such as agriculture, healthcare, finance, education, energy, and transportation.

Whether you're innovating within these industries or addressing existing challenges, you have the chance to make a real difference in your community and beyond.

In 2020, Briter Bridges released data on the innovation maps across Africa showing how innovation across various sectors has impacted the African landscape. Our growth across the continent is directly impacted by our adoption of innovation but as you navigate the growing startup ecosystem, you may encounter numerous challenges leading to startup failures:

Inadequate Planning: Many African startup founders struggle due to insufficient planning, particularly in understanding market dynamics. Often, startups adopt a simplistic approach without thorough market analysis, neglecting crucial factors like target market suitability and solution viability.

Corporate Governance: Despite excelling in innovation, founders frequently overlook essential aspects of business management and corporate governance, creating loopholes for misconduct and abuse, which can undermine long-term success.

Poor Equity Management: Neglecting effective equity management can have detrimental consequences. Many founders fail to grasp the complexities of their projects and markets, leading to mismanagement and missed opportunities.

Poor Financial Management: Some startups suffer from poor financial management, making misguided investments or overspending without tangible returns. This mismanagement often leads to the downfall of promising startups.

In essence, effective equity management is crucial for startup founders to optimize ownership in their company, secure their financial future, and navigate financial challenges while minimizing risks and seizing growth opportunities.

Beyond managing cap tables, it involves understanding taxes, optimizing finances, and ensuring sufficient cash flow, empowering founders to make informed financial decisions for long-term security and success.

As a startup founder, effectively managing equity is key to securing your financial future and building generational wealth. Even if finance isn't your strong suit, grasping the basics is vital. Just as companies have finance departments, you need to forecast your liquidity, handle taxes, and seek financing to safeguard your savings. By using ventures for long-term financial stability, you can open doors for your family and future descendants. This means not just making profits, but also adopting sustainable business practices and wise financial management.

A. Equity & Liquidity in African Stock Markets

In the US and other advanced economies, you've likely noticed an increase in wealth accumulation and liquidity, with stock equity playing a critical role in this growth.

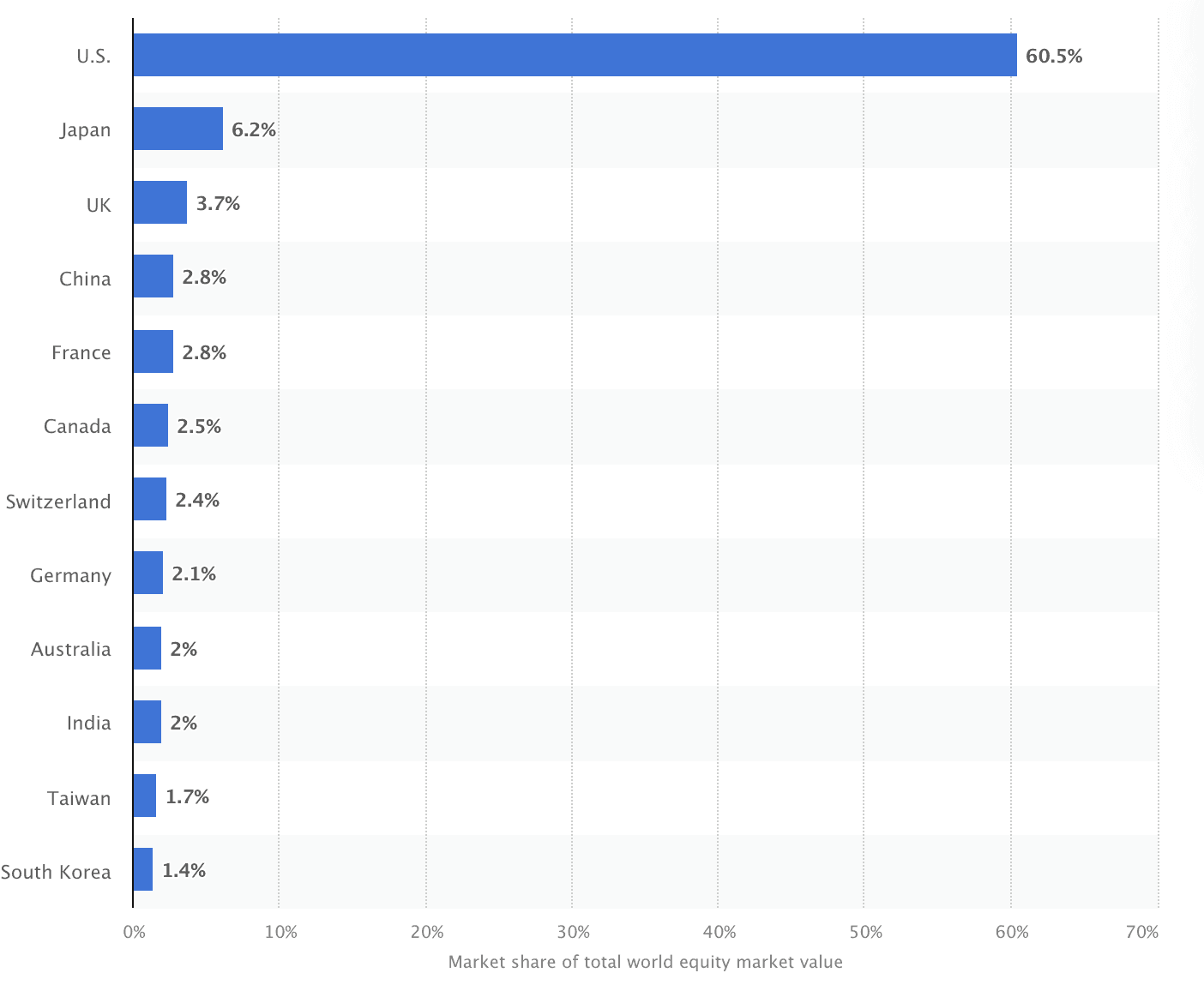

According to Statista, in 2024, stock markets in the United States made up roughly 60 percent of world stocks. Over half of adults in the United States are investing money in the stock market.

Stocks are appealing investments due to their potential for higher returns compared to other financial instruments. A report by Oxford Business Group reveals that African stock exchanges have a total worth of about $1.6 trillion, making up approximately 2% of the world's stock market value.

If you're involved in private equity investment in Africa, you might be facing challenges due to the limited liquidity in African stock markets. Unlike mature markets where exits are commonly through public stock markets, African investors often rely more on private trade sales. This lack of liquidity stems from various factors, including regulatory barriers, outdated technology, and macroeconomic and political instability. However, regulatory reforms, technological advancements, and market reform programs are underway to address these issues and promote liquidity. These efforts aim to attract more investors, improve trading efficiency, and foster cross-border transactions, ultimately facilitating growth in African stock markets.

Overall, the African market still grapples with an equity ownership problem, limiting the ability to benefit from the appreciation of financial markets. Closing this gap requires initiatives to promote proper equity management, financial literacy, and access to investment opportunities.

B. Understanding Startup Equity Ownership

When you own equity in a company, you're essentially claiming a piece of ownership. This ownership stake can belong to various individuals, including founders, investors, and employees. It's a way to tie everyone's interests to the company's success, often serving as a motivating factor for employees over the long term.

In the public sphere, equity is traded as stocks, while in private companies, it's typically offered to employees, accredited investors, and qualified purchasers. Equity comes in different forms, such as common stock, preferred stock, or equity awards like stock options, restricted stock awards, and restricted stock units.

To realize the value of equity, private markets rely on liquidity events like mergers, IPOs, or secondary market transactions. Understanding the worth of your equity involves considering factors like the number of shares, acquisition cost, and the company's overall valuation.

The concept of the ownership economy aims to make ownership as common as salaries, and Raise Equity Management Platform contributes significantly to this goal by expanding equity ownership across numerous companies and millions of shareholders.

It's crucial to establish proper infrastructure early on to avoid complications later. If you see your startup equity as a potentially life-changing asset, it's essential to evaluate its long-term value. While success isn't guaranteed, understanding the potential impact of your equity on your financial future is paramount.

C. Value of Startup Equity

Managing startup equity presents unique challenges and considerations for you. While you may see yourself as financially wealthy based on your equity, you might lack liquidity for lifestyle upgrades or traditional loans. Moreover, the value of your equity is subject to market fluctuations, which can pose concentrated risks to your income.

Despite the uncertainties that come with startups, there's the exciting potential for significant wealth through your equity. The question then becomes how to realize the full potential of your equity as a founder and make the most strategic decisions for your personal future and your startup's future.

Consider Scenario 1:

You've founded a promising startup and secured funding in a Series A round. Your team is expanding rapidly, and there's high demand for your product or service. In the midst of this growth, you're given the chance to "early exercise" your stock options.

While it may require a significant upfront investment, think about this: if your startup achieves a billion-dollar valuation in a few years, exercising those same options could be much more costly. By taking the opportunity to exercise early, you secure favorable terms and position yourself for maximum financial gain in the long run.

Scenario 2:

In another scenario, imagine that your startup has been approached by a larger company for a potential merger or acquisition, a significant opportunity to realize the value of your equity.

If the deal goes through, you could receive a substantial payout or equity stake in the acquiring company. However, navigating such a transaction requires careful consideration of various factors, including valuation, cultural fit, and the long-term vision for your startup. By effectively managing your equity and negotiating favorable terms, you can ensure that you maximize the value of your stake in the event of a merger or sale.

As you keep growing a business in Africa, keep in mind the exciting opportunities awaiting you. Despite some tough hurdles like red tape and infrastructure issues, the tech scene is booming. Investors are taking notice, and there's a real chance for big success. Just remember to divvy up equity fairly, plan for cashing out down the road, and manage your money wisely.

Read the second part of this article where we discuss using your equity ownership in the business to set up financial security for your future.