#BuildingForBella: Part 7- Comprehensive Strategies for African Founders in the Face of Currency Volatility

February 24, 2024

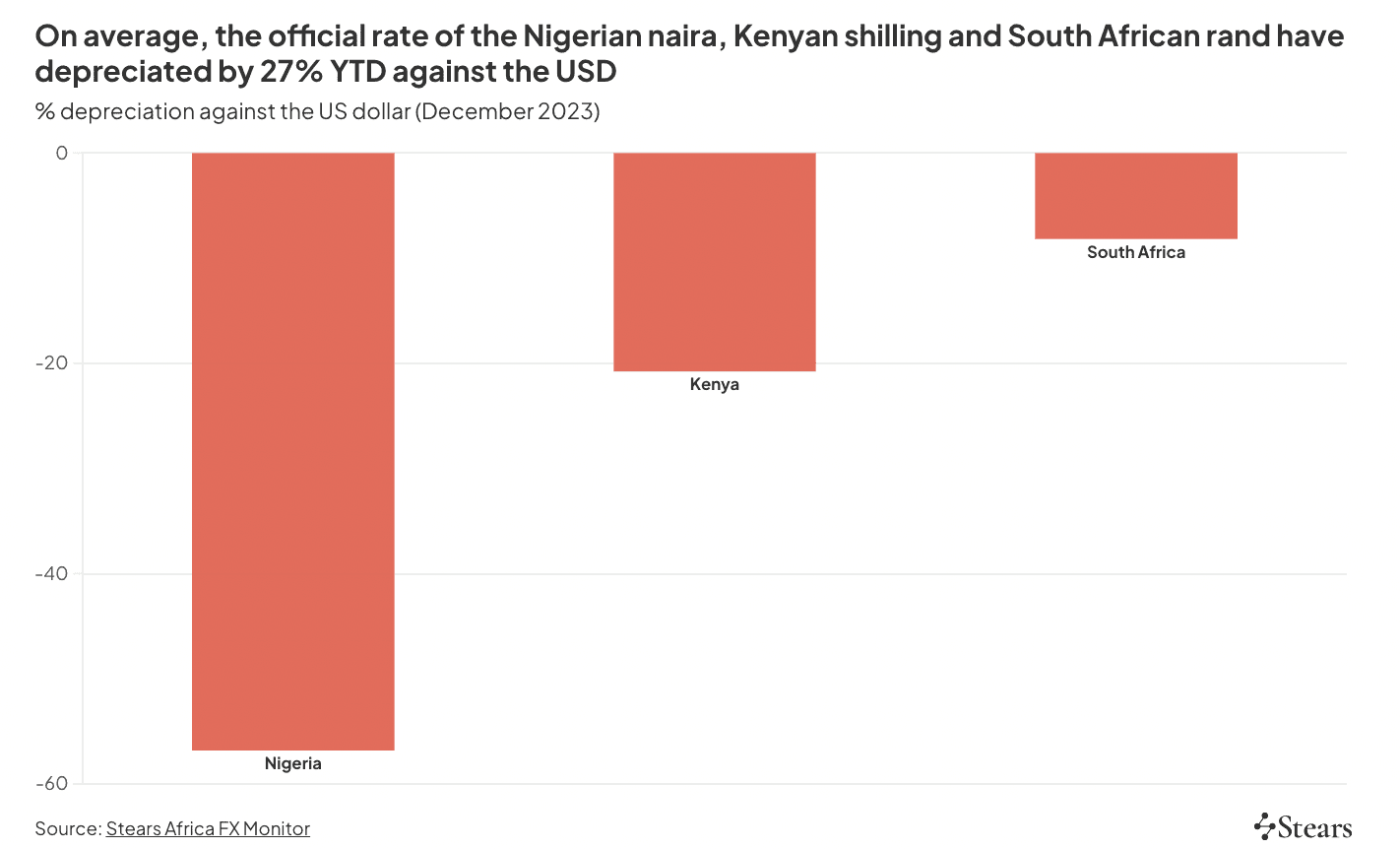

Across the African continent, the ever-present challenge of currency volatility poses a significant obstacle for businesses. As African founders strive to safeguard their ventures against the uncertainties of fluctuating currencies, the need for comprehensive strategies becomes increasingly apparent. Earlier this year, Stears shared an article on 2024 FX outlook among key African markets in the face of exchange rate instability.

Recent developments in FX fluctuations across various countries underscore the necessity for nuanced approaches to business management and operations within the continent. How can African founders adeptly navigate the intricacies of currency volatility within their domestic markets? Below, we delve into key strategies that African business operators can consider, addressing the multifaceted challenges posed by fluctuating currencies.

1. Proactive Financial Stewardship

Businesses can deploy a proactive shield through robust currency risk mitigation strategies. The key lies in preserving financial stability by diversifying financial holdings, maintaining a portion of reserves in stable foreign currencies. This approach acts as a buffer against sudden currency fluctuations, ensuring a more predictable financial landscape. For African startups, embracing proactive currency risk mitigation becomes foundational for building resilience and navigating uncertainties with greater confidence.

2. Tailoring Strategies to Home Markets

Understanding the intricacies of the domestic financial landscape is pivotal for startups seeking to thrive amidst currency volatility. Engaging with local financial experts provides insights into economic trends, regulatory dynamics, and currency stability specific to their home market. This localized financial planning empowers startups to make informed decisions, tailor pricing strategies, and establish financial reserves that account for the unique challenges posed by their domestic market. By incorporating localized knowledge, African startups can enhance their adaptability and resilience in the face of currency fluctuations.

3. Safeguarding Financial Stability

Strategic hedging is a powerful tool for startups looking to safeguard their financial stability in the face of currency volatility. Exploring mechanisms such as forward contracts and financial instruments designed to protect against adverse currency movements creates a robust financial safety net. This strategic move allows startups to maintain a stable financial position even during periods of heightened currency volatility, ensuring business continuity and facilitating the pursuit of ambitious growth initiatives. Strategic hedging serves as a dynamic and forward-looking strategy for African startups, providing a means to navigate the turbulent waters of currency fluctuations.

4. Adapting to the Currency Landscape

The ever-changing currency landscape demands adaptive strategies, and dynamic pricing models stand out as a key approach for startups. By adopting dynamic pricing models, startups can adjust pricing dynamically in response to fluctuations in the exchange rate. This approach ensures competitiveness without compromising profitability, providing the agility needed to respond to currency fluctuations in real-time. Dynamic pricing models form a strategic tool for African startups, allowing them to optimize pricing strategies and maintain a competitive edge in the market.

5. Nurturing Stability within Markets

Recognizing the importance of building a resilient financial ecosystem within the local market is a cornerstone for startups facing currency volatility. Cultivating strong relationships with local financial institutions, adopting technology solutions to monitor and respond to currency trends in real-time, and implementing stringent financial risk management practices fortify startups against the impacts of currency volatility. These measures foster resilience and sustainability in the face of economic uncertainties, preparing startups to weather the storms of currency volatility and emerge stronger on the other side. Building resilient financial ecosystems involves not only adapting to current market conditions but also proactively preparing for future uncertainties, ensuring that startups are well-positioned for sustained growth in the dynamic African business landscape.

By integrating these strategies into your startups operational frameworks, you can fortify your ventures against the uncertainties of fluctuating currencies, laying the foundation for sustained growth and resilience in the dynamic African business landscape.

Chat with us on WhatsApp to speak with experts on Financial Modelling, Fundraising, Equity Management, Valuation and other key concepts you need to stay structured during these recent times.