Building a valuation for African startups

July 28, 2021

Your startup is more valuable than you think 💵

Creating a financial value for your startup is really important since it will determine most things about your startup: your share price, number of shares and growth trajectories.

Valuation is a big and frustrating topic. Luckily this post will clear it up a bit.

Today, we’ll focus on the process of creating value for your company — and in a future blog — a deep-dive into the different startup valuation methods.

Over time, we’ll be releasing digital tools that allow you to create value for your startup in just a few clicks.

Let’s begin. Below is a story where a startup’s valuation will grow at each significant milestone in the company.

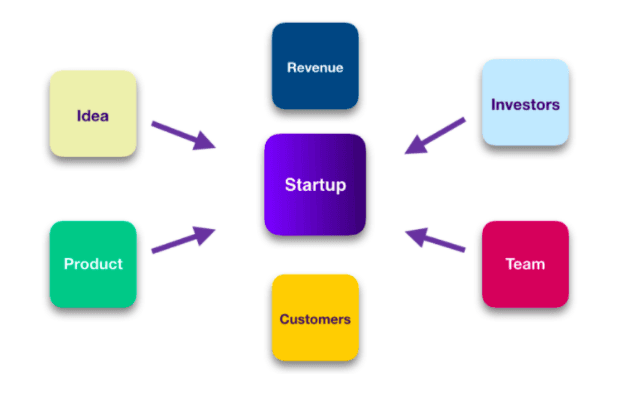

You have a great business idea that you believe will solve a problem. You’re right — your startup now has a value.

So, you do what any dreamer would do — convince people to rally around the idea and create a core team of founders, advisors and colleagues. Every member of your core team brings something to the table — years of experience in this field, business insight and technical expertise. To build a great startup, you need a great team — so yes, your startup’s value went up when your team joined you.

Next, conduct your target market research. Who are the big players? What is the potential scalability of the product and idea? Is there a product-market fit? Your niche offering, size and growth of the market and whether your approach is business to business (B2B) or business to consumer (B2C) will determine a value for your startup. Your startup’s value just went up.

You’ve managed to convince some angels and maybe an accelerator to invest pre-seed money into the company. You’re on your way to building that idea. Any form of capital or grant increases your company’s value — your startup’s value just went up.

Great! Now you’ve counted a core team, idea, market and pre-seed money for your MVP. The startup is growing — and one day, you decide to raise a seed round. A seed round is where a startup usually gets its first real valuation from investors. At the seed round investment is where you need to create, negotiate and defend a valuation.

To do set a valuation, you’ll need two tools in your arsenal: (1) a compelling story about your startup; and (2) data-driven proof that defends the story.

Together, a compelling story and data-driven evidence help you build a compelling valuation that is fair to both the core team and investors.

To create and defend a strong valuation for your startup, you’ll need to tell a story that assumes the company’s potential growth. To do that, you’ll need to prove why you can achieve that growth, based on your past performance. So, it’s important to document the startup’s journey with as much proof as you can — records of product iterations, employee contracts, intellectual property agreements and your market traction.

The difference between post and pre-money valuations

As usual, there’s a lot to unpack in this topic — so today we’ll leave a useful tip about something that we see get confused a lot in our community: (1) Pre-money valuation; and(2) Post-money valuation.

A pre-money valuation is the financial value of the company before a new investment in the company. It’s basically what founders and investors will negotiate and agree is the value of the company before they invest (for instance, at a seed round). For example, the pre-money valuation of your company could be $1,500,000 — and is based on your idea, team, product and market.

A post-money valuation is your new valuation after the investment. All you need to do there is take the pre-money valuation, add the investment amount, and the result is the post-money valuation. For example, if investors invest $500,000 into a startup with a pre-money valuation of $1,500,000… then the post-money valuation is $2,000,000.

If this is confusing, always remember — a pre-money valuation is the valuation pre (before) the new money invested. A post-money valuation is the valuation post (after) after the new investment.

Pre-money + Investment amount = Post-money valuation

Hold on tight, and read carefully. The new post-money valuation will become the foundation for negotiating a pre-money valuation at the next round of financing. For example, now that your post-money valuation is $2,000,000 — when you raise money again, you’ll use that $2,000,000 to negotiate a new valuation based on the growth of the company since the last round of financing.

#raisetip

A pre-money valuation is the valuation pre (before) the new money invested. A post-money valuation is the valuation post (after) after the new investment.

Until the next post! #keepbuilding.

DISCLOSURE: This communication is on behalf of Raise Impact Technologies Inc. (“Raise”). This communication is not to be construed as legal, financial or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Raise does not assume any liability for reliance on the information provided herein.