Attracting Smart Money With Clean Cap Tables

July 7, 2024

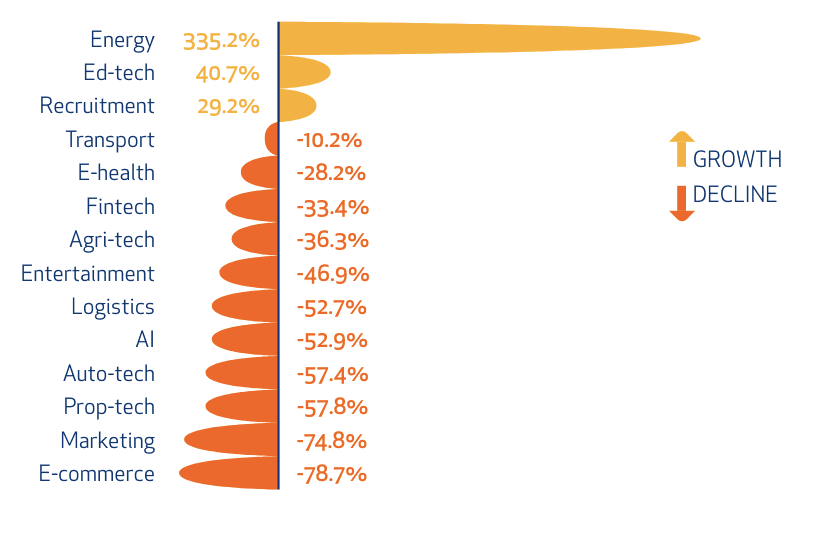

In 2023, the African tech funding landscape experienced a notable downturn, and with nine sectors witnessing substantial drops in total investment. E-commerce and retail-tech, traditionally robust sectors, faced the largest decline, nearly 80% down from previous levels. Amidst this downturn, only two sectors—ed-tech and energy—managed to secure increased funding compared to 2022 as reported by Disrupt Africa. This growth was particularly crucial as smaller sectors, which had been growing rapidly, suffered the most. Economic uncertainties and global market conditions have made investors more cautious.

Investors are becoming more strategic and selective with their investment decisions. They are now more selective, looking for startups that not only have potential but also present a low risk. This has made it harder for startups to secure funding, especially those that lack transparency and organization in their financial and ownership records. This trend means that startups need to be more prepared and transparent to attract "smart money."

Understanding "Smart Money"

"Smart money" refers to capital coming from investors who bring more than just funds to the table. These investors often have industry expertise, strategic connections, and valuable insights that can help a startup grow faster and smarter. Smart money investors are typically more selective and conduct thorough due diligence before making investment decisions.

The Challenge of Cap Table Due Diligence in Africa

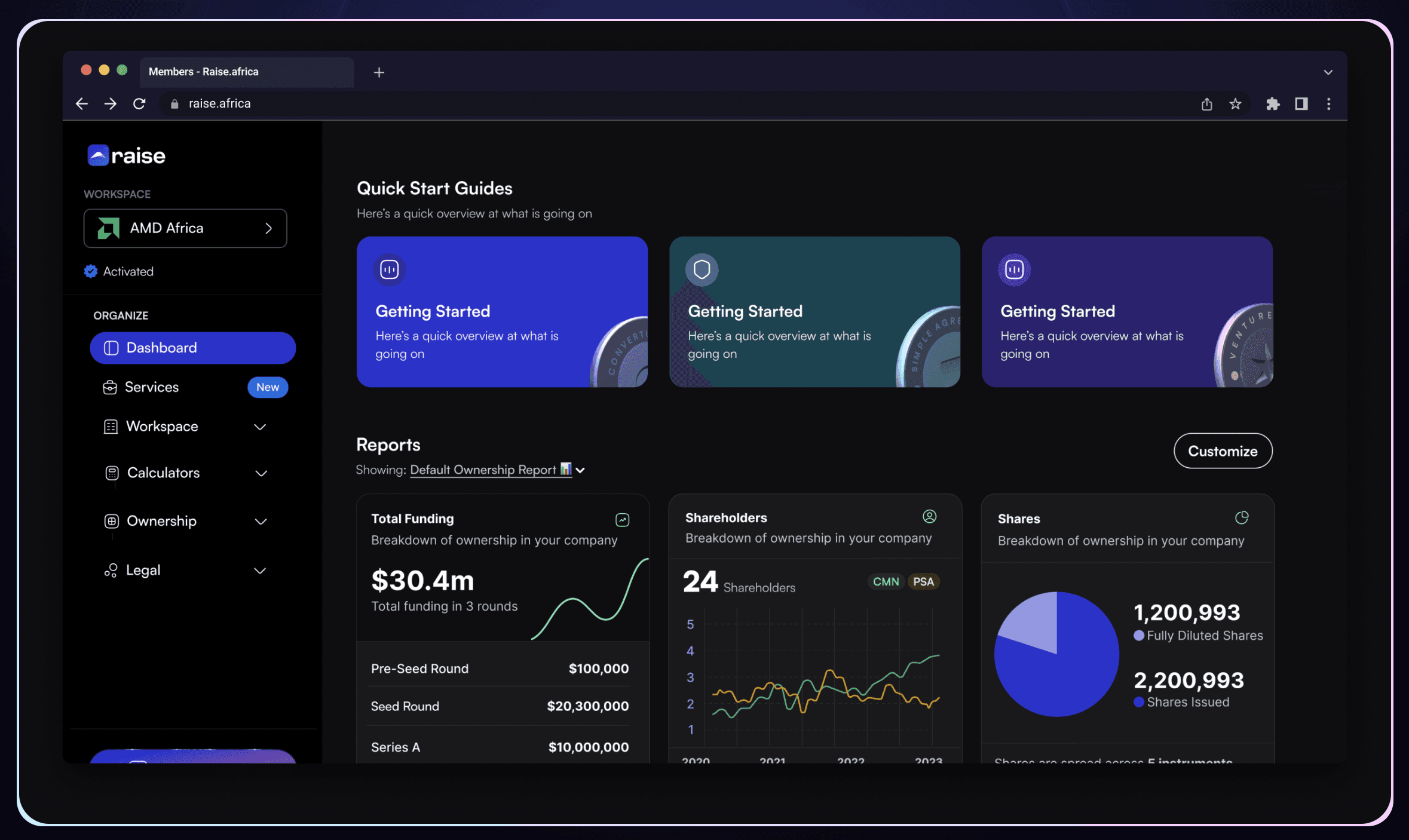

One of the significant challenges African startups face is maintaining a clean and transparent cap table. A cap table (short for capitalization table) is a detailed breakdown of a company's ownership, including shares, options, and other securities. Investors scrutinize cap tables to understand ownership structure, dilution, and potential returns on their investment.

Cap tables can become messy for several reasons. In the early stages, founders might not pay much attention to keeping detailed records. As the company grows and more investors come on board, the cap table can become complicated. If not managed properly, it can lead to errors and discrepancies.

Cap table management has become a huge problem in Africa. Many startups have disorganized or inaccurate cap tables, making it difficult for investors to trust the information presented to them. Messy cap tables cause problems during due diligence when investors are looking at the company’s financial health.

Due diligence is a critical part of the investment process. Investors need to be sure that the information they have about a company is accurate. A messy cap table can slow down this process, making it harder for a startup to secure funding. Investors might question the accuracy of other information provided by the company and this lack of clarity can be a significant red flag for potential investors.

Why Clean Cap Tables Matter

A clean cap table is essential for startups at any stage. Early-stage startups need it to attract their first investors, while growth-stage companies need it to secure larger funding rounds. A clean cap table shows that the company is well-organized and prepared for growth. It can make a startup stand out in a crowded market, giving it an edge over competitors who might have messy financial records.

Transparency and Trust: A clean cap table shows transparency, which builds trust with potential investors. It demonstrates that the startup is organized and has its financials in order.

Ease of Due Diligence: Investors need to perform due diligence to evaluate the potential risks and rewards of an investment. A clean cap table makes this process smoother and faster, increasing the chances of securing funding.

Avoiding Disputes: Clear and accurate records of ownership help avoid disputes among shareholders and founders. This is especially important as the company grows and more stakeholders become involved.

Strategic Planning: A clean cap table helps founders plan for future fundraising rounds, employee stock options, and potential exits. It provides a clear picture of how different scenarios might impact ownership and dilution

Attracting Smart Money with a Clean Cap Table

Investors bringing smart money are looking for startups that not only have potential but also demonstrate professionalism and readiness for growth. Here’s how a clean cap table can help attract smart money:

Confidence in Management: A well-maintained cap table shows that the management team is competent and diligent. This increases investor confidence in the team's ability to execute their vision.

Reduced Risk: Investors see a clean cap table as a sign of reduced risk. They know what they’re getting into and can accurately assess their potential returns.

Better Valuation: Startups with clean cap tables are likely to receive better valuations. Investors are willing to pay a premium for companies that demonstrate transparency and organization.

Streamlined Negotiations: Clear ownership records facilitate smoother negotiations. Investors can quickly understand their stake in the company and make informed decisions.

As the startup ecosystem becomes more competitive, having a clean cap table is not just a nice-to-have but a necessity. It can make the difference between attracting strategic investors and missing out on crucial funding opportunities. Let us help you clean your cap table and position your startup for success.

We provide the tools and expertise needed to ensure that your cap table is accurate, transparent, and investor-ready. By partnering with us, you can focus on building your business while we take care of the details that attract smart money.

Get in touch with the team directly. We are also available on WhatsApp here.