A Founder’s Guide: African Startup Valuation.

July 11, 2024

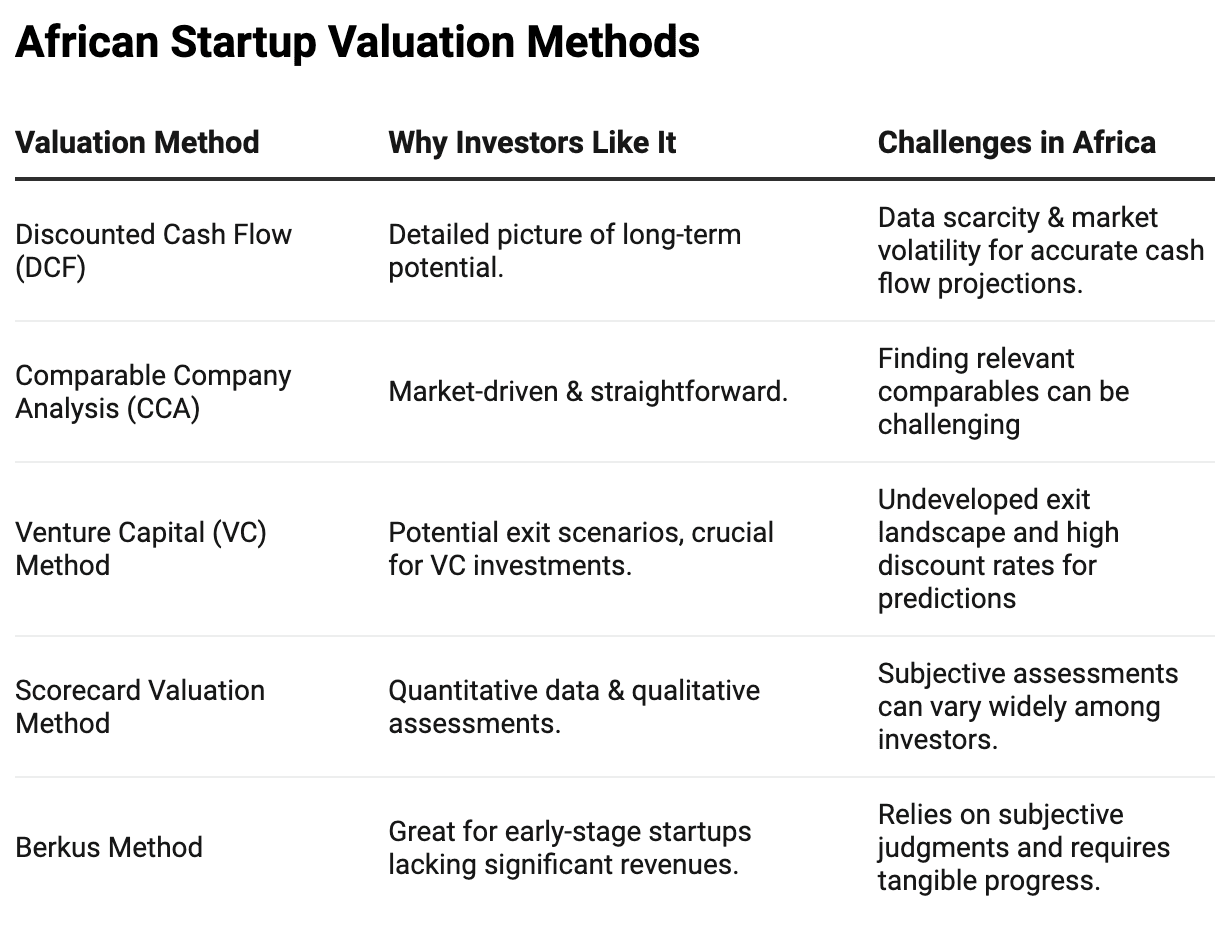

Valuation is crucial for startup fundraising, helping founders and investors make informed decisions about investment and growth strategies. A proper startup valuation report doesn't use one-size-fits-all approach instead focusses on specific valuation methods tailored to the startup industry and or market.

When assessing African startups for investment possibilities, investors prefer certain kinds of valuation methods to decide if and how much they should invest in your business. They use different methods to figure out the business' worth, considering both numbers and the overall potential. While challenges exist, the excitement and growth in the African startup scene make it attractive still.

In this article, we break down five of the most common valuation methods used on the continent.

1. Discounted Cash Flow (DCF) Analysis

Think of DCF as trying to predict how much money your company will make in the future, then calculating how much that future money is worth today. DCF basically involves estimating your future earnings and then "discounting" them to today's value using a specific rate, usually your cost of capital.

Investors like DCF because it gives a detailed picture of your business's long-term potential. They are able to peer into the future and see how profitable your company can become. The challenge with this valuation method is that predicting future earnings can be tricky due to less reliable financial data and market ups and downs. But it's a solid method when you have good data.

2. Comparable Company Analysis (CCA)

A CCA is done by comparing your company to other similar companies in your market.Investors look at how much those companies are worth and use that information to value your company. They compare metrics like sales and growth rates.

This method is market-driven and straightforward. Investors get a sense of what similar businesses are worth in the real world but sometimes, it's hard to find similar businesses to compare to, especially in new or unique markets. Plus, Africa’s diverse markets can make finding true comparables tricky.

3. Venture Capital (VC) Method

The VC method is tailored for early-stage startups. An estimate of the company's future exit value (e.g., through an acquisition or IPO) is carried out and then discounted back to the company’s present value, considering the high risks and required returns of venture investments.

It’s called the VC method because VCs like it a lot. It's simple and focuses on exit strategies, which are crucial for VCs. They want to know how they'll make their money back and more. A huge challenge however is that predicting future sales or exits can be tough because the market for selling businesses is less developed. Plus, high risks can lead to very high discount rates, potentially undervaluing your startup.

4. Scorecard Valuation Method

Imagine you’re grading your company on various aspects like the product, marketing, team, and location, etc. The scorecard method adjusts the average value of similar companies based on these factors.

This method is holistic and customizable for investors. They can tweak the weight of each factor based on your startup’s specifics. However, it can be a subjective method. Different investors might score your company differently. Local biases and limited market knowledge can also affect the accuracy of the method.

5. Berkus Method

Unlike the scorecard method that adjusts an average valuation based on a comparative scoring of various factors, the Berkus method assigns fixed values to specific early-stage milestones, like the idea, prototype, team quality, strategic relationships, and product rollout stage. It’s great for early-stage startups without significant revenues. It breaks down valuation into key components, making it easier to understand.

The challenge with this method is that early-stage startups might lack tangible progress. Plus, it’s subjective and relies heavily on investors’ judgment.

Remember, understanding valuation is crucial, but it’s just one part of your startup journey. Reach out to the Raise team to help you build your next valuation report.