M&As as a Growth Strategy- A case study of Appruve’s acquisition by SmileID

February 21, 2024

# M&As as a Growth Strategy- A case study of Appruve’s acquisition by SmileID

💡 Mergers & Acquisitions (M&As) have emerged as strategic tools for catapulting growth, especially in the African startup ecosystem. A recent noteworthy example is Smile ID's acquisition of Appruve.

In April 2023, S[mile ID, formerly known as Smile Identity](https://usesmileid.com/), a key player in Africa's ID verification and KYC compliance sector [acquired Appruve](https://techcrunch.com/2023/04/26/smile-identity-expands-african-footprint-with-acquisition-of-appruve-to-strengthen-id-verification-services/#:~:text=Smile%20Identity%2C%20according%20to%20its,documents%20and%20data%20types%20with), a data verification company based in Ghana, to bolster its identity verification services. The strategic acquisition expanded Smile ID's footprint across Africa, solidifying its position as the continent's leading identity verification and digital KYC provider. *While the deal's terms were undisclosed, it is reported to be a cash-and-stock deal of "not more than $20 million."*- TechCrunch. Smile ID, backed by over $30 million in venture capital investment, aimed to strengthen its offerings by incorporating Appruve's expertise in identity verification software and unique datasets, enhancing fraud prevention and KYC capabilities.

### 🚀 What’s the impact of the acquisition?

Mergers and Acquisitions have always served as a potent growth strategy for businesses seeking to expand, enhance capabilities, or achieve various strategic objectives. In the case of SmileID and Appruve, the acquisition brought together diverse expertise. Appruve's focus as a company on analyzing fraud data from global money networks, verification of mobile money financial statements, and blocklist data contributed localized insights that enhanced Smile ID's capabilities.

> *“These are relevant localized data that have long been left out of the bigger pool of KYC and fraud prevention.”* - Appruve founder and CEO Paul Damalie in a statement to TechCrunch.

>

With the acquisition, in a summarized statement, Smile ID was able to achieve its goal of navigating diverse markets and regulatory landscapes within Africa.

Aside from localized expertise, African startups often face challenges related to market gaps, technological advancements, and the need for rapid innovation. M&A allows companies to address these challenges efficiently. In this case, the union of the companies’ technologies and capabilities creates a more comprehensive product and solution, filling gaps in the market and accelerating innovation in identity verification and KYC services.

Beyond innovation acceleration and filling market gaps, M&A also helps with building investor confidence and mitigating risks. Through the combination of forces, the industry or market risks are shared and successful M&As signal to investors that companies are strategically positioning themselves for sustained growth.

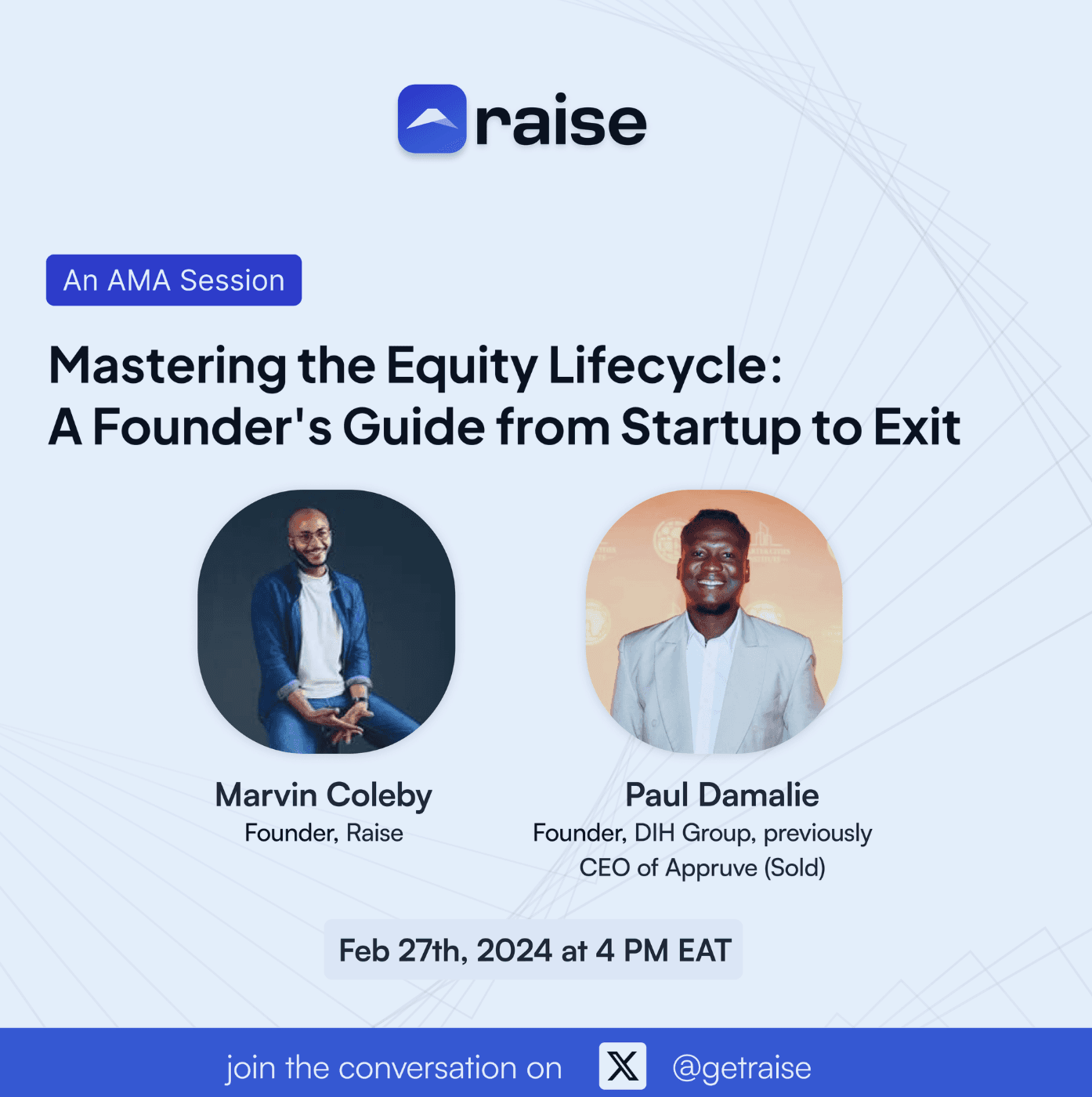

### Join us for a chat with Paul Damalie

🤩 Next Tuesday, we’ll be hosting a chat with Paul Damalie, the former CEO of Appruve on our X spaces. [Set a reminder here.](https://twitter.com/i/spaces/1RDxllkdZRlxL?s=20)

Paul will be coming on board for our Equity Mastery Series on how to master the equity lifecycle. As a founder, who has gone through the startup lifecycle stages, he brings a wealth of firsthand experience and insights to the table.

Having successfully navigated his startup journey to the M&A stage, Paul will share invaluable lessons and strategies for mastering the equity lifecycle. His practical knowledge, coupled with the challenges and triumphs he encountered, makes him the perfect person to guide fellow founders, entrepreneurs, and industry enthusiasts through the intricacies of equity management, startup valuation, and the dynamics of reaching the M&A pinnacle.

Whether you're a founder, investor, or just curious about the startup rollercoaster, this is your backstage pass to tales that redefine the African startup landscape. Join us for an engaging session with Paul as we delve into the intricacies of the equity journey and glean wisdom from a seasoned entrepreneur who has not only weathered the startup storms but has triumphed in the M&A landscape.

👉 Need insight on Equity Management, Cap Tables, Valuations & More? Chat with us on WhatsApp and get instant responses to your enquiries: [https://wa.me/254799598541](https://t.co/fcd5WzfgQY)