Introducing raise.africa

April 18, 2023

# Introducing raise.africa 💫

---

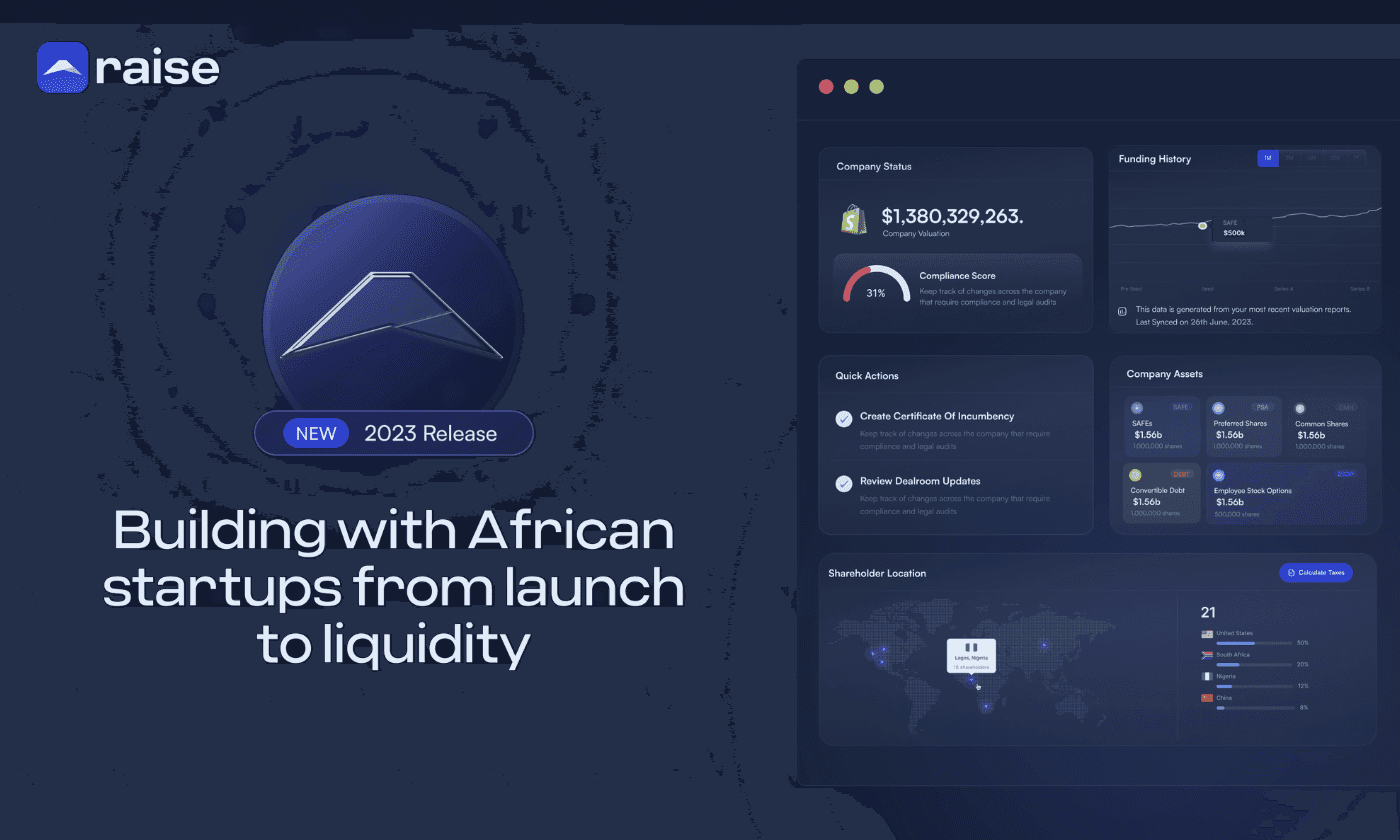

Today we are making a visual change at Raise. It’s still us, just better. This represents our internal growth from just a cap table product to a full-stack equity platform that can design a Pan-African company’s journey, from launch to liquidity. Our vision is stronger than ever: to raise Africa, one startup at a time.

---

💡 TLDR:

We're introducing a new product line and brand called [raise.africa](https://raise.africa/). Our goal is to create more equity owners in the African startup ecosystem. We've helped thousands of entrepreneurs, lawyers and investors in the African technology ecosystem fix the problem of equity ownership, and we've learned about the complexity of servicing corporate structures across Africa. Our dream is to rebuild Africa’s capital markets engine and enable founders, employees and investors to finance Africa’s economic renaissance.

Our core thesis is that the next generation of entrepreneurs, startups, and private companies will build a better Africa. We believe that we're all on the same team, and that shared equity ownership across the ecosystem could get us to our goal even faster.

We're launching early access at [**raise.africa**](https://raise.africa/), where you will get early access to Raise Core, a set of products dedicated to making equity management simple for African founders, from launch to liquidity. We’ll also be launching Raise Labs, a collection of our research over the years to build Africa’s equity on-chain. We’ve experimented all kinds of digital equities, from helping MakerDAO build its real-estate bridge for DAI, building on ERC standards for equity and ideating indexes for African equity on the Lightning Network. It’s time to share our learnings and mission.

Here’s our story.

---

# **Building a bridge for Africa’s capital markets 📊**

---

In 2019, we launched Raise when African startups had only raised $700 million dollars for the whole year of 2018. We started as a cap table product and our fundamental goal never changed: to create more equity owners in the next generation of the African startup ecosystem. Since then, we’ve seen an increase in the value of investments in Africa’s technology ecosystem. Next quarter, we’ll pass $20 billion dollars invested in this ecosystem. That’s 2 trillion Kenyan shillings, 3 trillion Nigerian Naira and 360 billion South African rands.

Every part of that total value represents the sale of equity ownership in African startups. That means a lot of corporations are being built every day across the ecosystem. Those corporations enable teams of people to group together and scale ownership. The African technology ecosystem’s ownership network is a dense network of SAFEs, shares, flips, debt and options that are owned by various fund & syndicate structures. If we drill even further, you’ll find pensions, real estate trusts, pension funds, public stock exchanges and ownership vehicles scattered across the continent of Africa.

As a founder, you know that equity ownership is everything you’re driving towards. It’s how you get investors onboard, it’s how you get employees to build incredible things and it guides your most important business decisions for all your stakeholders. As Raise, we see equity ownership as a tool to scale economic independence across Africa, which is mission-critical for accommodating Africa’s growth.

Africa’s ownership graph is large and hard to quantify because most of it is on paper or scattered throughout excel sheets and data rooms. But, we do know that if you mapped the ownership graph with predictive models of Africa’s population growth, we can build a platform that creates more owners by bridging private and public capital markets in a way that we can fund our own Pan-African economic agendas.

A successful bridge that can collect and clean $20 billion dollars worth of equity in African companies, could become one of Africa’s largest stock exchanges. Over the years we’ve drilled deeper and worked with the biggest funds, law firms & startups across the ecosystem. We’ve learned a lot and there’s a lot left to learn.

Who knew this market was so big?

# **Our evolution to [raise.africa](https://raise.africa/) 🔥**

---

The first problem we set out to solve at Raise was the electronic recording and registry of equity ownership ('cap tables'). It may seem hard to believe, but in 2019 we could not find many founders or investors that cared about accurately tracking the latest percentage ownership in their companies. Over the years, that problem has grown exponentially. The typical African startup is a dense web of multiple entities, licenses and investors across all borders. On average, we spend between $30,000 and $150,000 per year to get legal advice on an industry that’s still only a few years old.

We helped over thousands of African entrepreneurs fix this problem, and we learned about the complexity of servicing corporate structures across Africa. We launched the alpha versions of Raise in 2019, followed by the beta in 2020. Our first major milestone when we joined the Binance Labs incubator in 2019 was to onboard over $1 billion dollars of the market capitalization of companies on Raise. We passed that goal in November 2021 and closed a seed round with notable investors like Carta, Binance and over 40% of the top 20 investors in African technology companies.

At each step, we learned a ton from our beta products & services, and we’ve collected all of those financings for the early access release of [**raise.africa**](https://raise.africa/). Our next North Star metric is to onboard $20 billion dollars worth of African technology companies, which would mean that we have a higher market capitalization on the platform than the combined value of 20 of the major African stock exchanges.

With the majority of Africa’s private assets on Raise, we get to continue experimenting with solutions to hard problems in our ecosystem using a combination of corporate products like a cap table tool, or liquidity products on rails for decentralized finance. By solving the problem of digitizing equity ownership, we’re building an ownership network across Africa for people to leverage a platform that takes their companies all the way from launch day to liquidity.

The next evolution of Raise will be at [**raise.africa**](https://raise.africa/). We’ve rebuilt our entire product and service suites from the ground up, to be able to handle complex late-stage transactions with the simplicity of a pre-launch startup. We’re integrating local regulations, licenses, financial markets and valuation methods to create a more robust platform for your lawyers, investors and employees. The next versions of Raise will remove the legal barriers for African startup teams and provide a simple platform for managing equity, with local customer success teams that genuinely care about building African startups across critical industries.

Everything we do and build on [**raise.africa**](https://raise.africa/) is driven by an unshakeable core thesis that is anchored by three beliefs

# **Our core thesis and three beliefs ⭐️**

---

Our core thesis is that the next generation of entrepreneurs, startups, and private companies will build a better Africa. So that’s why our vision is simple: to raise Africa, one startup at a time.

Our core thesis is made of three beliefs.

1. The first belief is that we’re all on the same team: we face and survive the same barriers. If we’re invested in each others' success, that could have a multiplier effect on our shared goal to build a better Africa. Shared [equity ownership across the ecosystem](https://us.macmillan.com/books/9781250183866/extremeownership) could get us there even faster.

2. The second belief is that we don’t have much room for mistakes to get this right. Africa is at an [inflection point](https://thebusinessprofessor.com/en_US/economic-analysis-monetary-policy/inflection-point-definition) of growth, and things can either go right or wrong from here. If we get it right, we [raise Africa](https://www.ey.com/en_gl/tax/why-africa-is-becoming-a-bigger-player-in-the-global-economy) to [economic freedom](https://www.brookings.edu/research/sub-saharan-africa-land-of-promise-or-of-peril-a-complex-narrative-of-a-continent-in-flux/). If we get it wrong, [things will become more chaotic](https://www.imf.org/en/Publications/REO/SSA/Issues/2022/10/14/regional-economic-outlook-for-sub-saharan-africa-october-2022).

3. The third belief is that the digital economy could give startups a chance to get it right. The problem is that we’re making a lot of mistakes that are compounding into growth barriers for the startup ecosystem.

Put these three beliefs together and you’ll see our conclusion. We have an opportunity to build a better Africa, and we need to get this right. It’s not optional. Startups will build all major sectors of Africa’s economy: financial services, healthcare, energy, and water. We’ll need shared ownership of this economy to build it together, and we’ll need a platform that organizes it all so that we have a shot at getting it right.

Startups are responsible for the next wave of Africa’s progress. Everything we do at Raise is driven by genuine care to build a better Africa. It is a core value. We are African people and share a belief in economic independence being a successful outcome for African communities. The digital economy will play an important part in getting us there.

Africa has three potential scenarios to go through over the next few decades. The worst case is we fall into corruption, politics and overall income inequality and inflation. Looks a lot like what we’re going through now. The medium case is things continue and we make moderate improvements. The best-case scenario is a renaissance, where we build the infrastructure for a happier, wealthier and greener continent.

The choice is now and happens between now and 2030. Capital markets are playing a critical role in this transformation, and our north star metric is aligned to create that best case.

Africa 2050 Futures Project, full PDF [here](https://www.files.ethz.ch/isn/126598/Mono175.pdf). Blue is what happens when we get it right and trigger [an African Renaissa](https://en.wikipedia.org/wiki/African_Renaissance)nce. People have access to wealth, governments can fund growth and African states cooperate.

# **What’s next ✅**

---

You can expect a few things from us over the next few months:

1. **Early access:** Join our early access at [raise.africa](https://raise.africa/), where we’ll begin shipping refreshed core equity products to power African startups from launch to liquidity. Subscribed customers will get access to Raise Labs, where we experiment and release liquidity products using decentralized financial technologies and integrations.

2. **Later stage:** we’re moving up the later stage stack of companies. To date, we’ve built products for pre-seed companies. Soon, we’ll be able to accommodate much more complex later-stage companies and your corporate structuring and liquidity needs.

3. **Raise Labs:** we’re combining all of our research over the years into one entity, called Raise Labs, which will be dedicated to experimenting with liquidity products in African technology. The first ones to roll out will be for primary raises and secondary trades with later-stage institutional investors, followed by more fun ones like a startup index (like DeFi pulse), and Bitcoin-backed stock exchanges pegged to the Naira.

Stay in touch, and catch us on twitter: [https://twitter.com/getraise](https://twitter.com/getraise)