3 Reasons: Flipping from Africa to Delaware (and when not to)

August 16, 2021

As a founder, choosing where to incorporate your startup is an important and defining moment. If you’re at this stage in your founder journey, you’ll have certainly heard about the practice of flipping your company to another country. If you (much like myself at one point) don't fully understand what a flip is and what the process entails, then look no further. In this series, we’re going to go over what a flip is, why you’d want to flip your company and the process of doing so - especially for Nigerian and Kenyan startups flipping to Delaware in the United States.

So first things first, what is a flip? 🏄

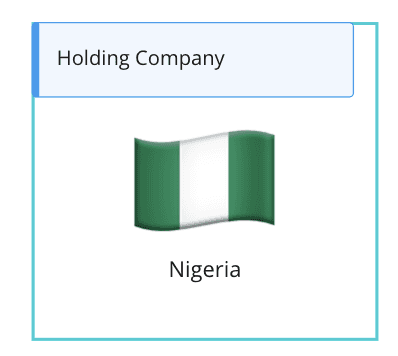

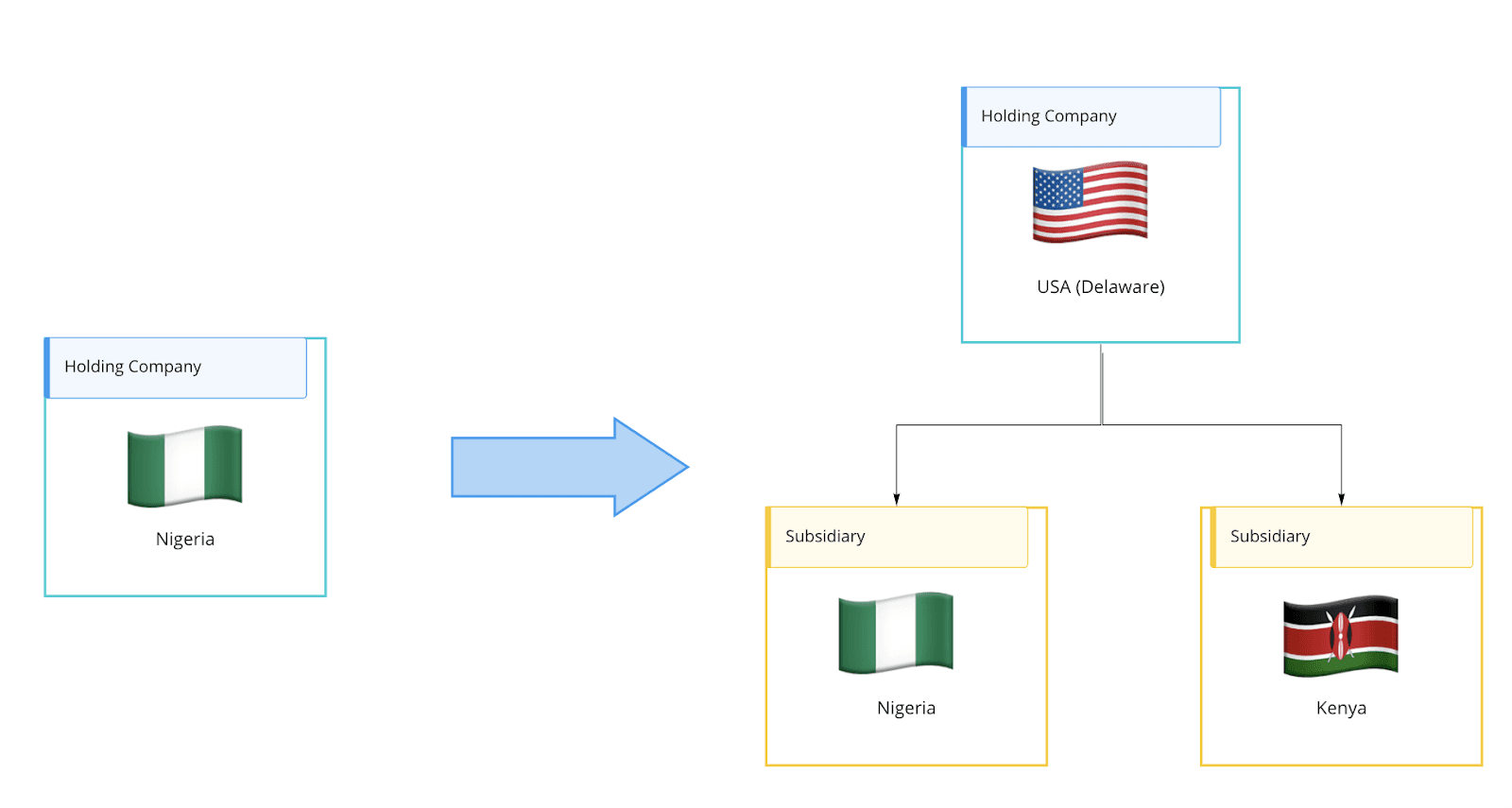

A flip is when you move from being a Nigerian or Kenyan owned company, to being a Delaware company with Nigerian and Kenyan subsidiaries. A flip involves incorporating another entity in a foreign jurisdiction and issuing shares in that entity to investors and founders, reflecting their respective shareholding in the local entity at the time of incorporation. This is what your company looks like before a flip.

Thereafter, all shares in the local entity are transferred to the newly incorporated foreign entity creating a wholly owned subsidiary. Through this process, founders and stakeholders can raise capital at the level of the parent company and trade at the level of the local entity. This is what your company looks like after a flip.

So, why is this so important?

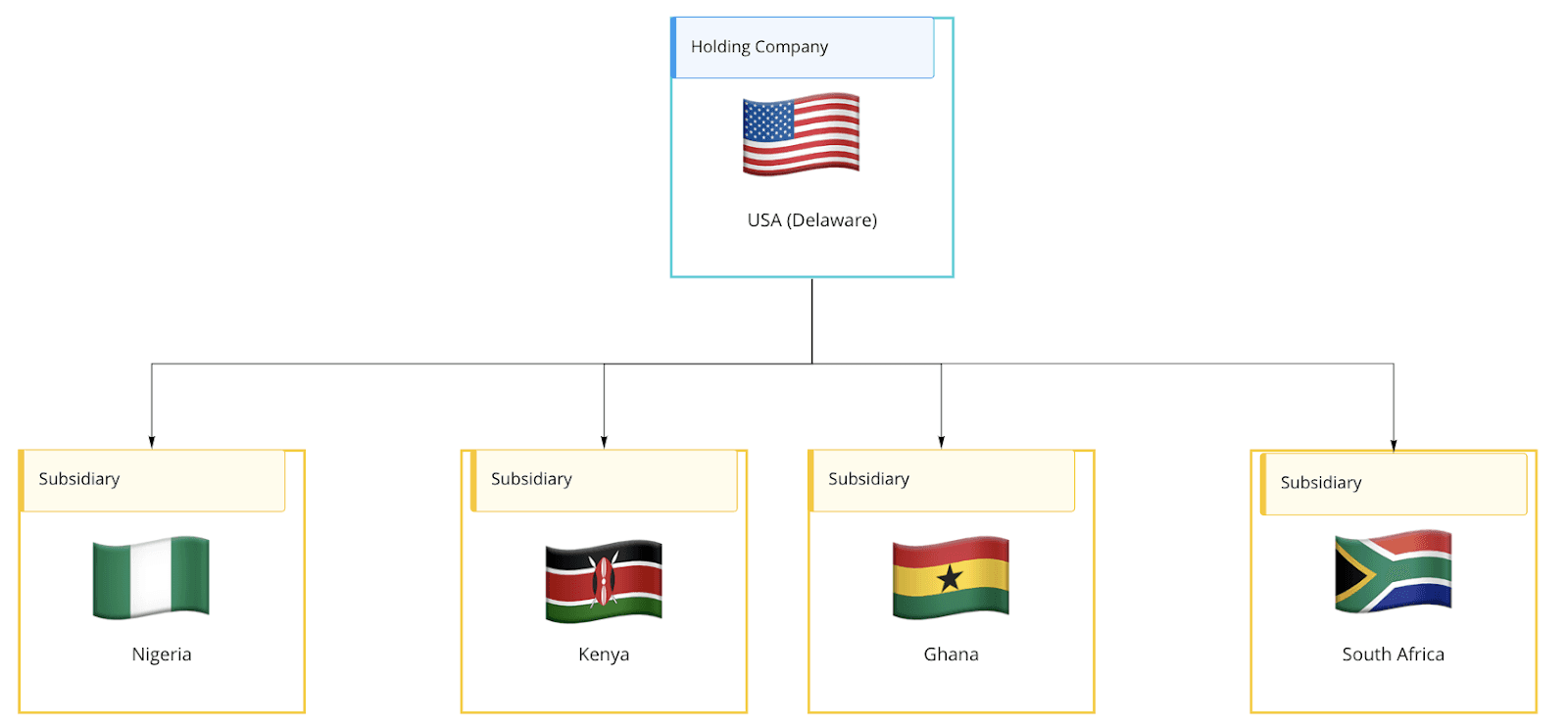

There are tons of reasons to flip. Most importantly, it’s really important. The decisions you make now could last the rest of the company’s lifetime. As you grow, the company will add on more and more subsidiaries, and things get very complicated over time as you scale across Africa.

Now, let’s get into some reasons why you should do a flip, and some reasons you should not!

3 reasons to flip:

Reason 1: It’s easier to raise money 💵

Perhaps the most important consideration determining choice of incorporation is access to money. Raising capital is a necessary goal for every future startup, how do you think Fawry, Paystack, Safaricom, Bamboo and Flutterwave got to where they are?. To give themselves the best chance at success, founders are drawn to jurisdictions with extensive capital pools and sustained venture capital practices.

As such, companies often flip to jurisdictions like Delaware or Canada, where they are far more likely to find eager investors willing to part with their 💰💰💰 and help fund the next generation of growing Pan-African startups🦄

Reason 2: It’s easier to get cash for your shares in secondaries or exits ✌

It’s the end of the road. You’ve raised, produced an MVP, taken it to market, scaled and built a thriving business. Stripe comes calling. They’d like a piece of pie 🍕; to share in or own all of your success. For a generous price, of course. Now this may or may not be your end goal but if it is, it’s often easier in foreign jurisdictions, as compared to Nigeria and Kenya.

Offshore holding companies incorporated in jurisdictions like the U.S. or Canada typically offer greater exit opportunities. Their laws and templates are better set up and make it easier to create cash from stock for all of your hard work over the years.

This may be an observation you make as a founder or it may be the position taken by your VC backer. Whether it’s the larger and (arguably) more spendthrift group of investors in jurisdictions like the U.S.; or perhaps the larger group of trade buyers sizing up a new acquisition - some markets boast more deal activity than others and this should play into your thinking. What’s more, if you fancy an IPO as your exit route, where better to list than the New York Stock Exchange?

Reason 3: The best regulatory set up 🌍

In an ever globalized world (at least, pre-Covid that is) oftentimes the choice of country for your flip comes down to which country offers the best mix of regulations 🍸. The business equivalent of say, summer in the Hamptons and winter in the Bahamas is a holding company in a low tax jurisdiction and a trading company in an under-penetrated market (well, kind of).

Confusing analogy aside, you may choose to flip because certain other jurisdictions offer a combination of laws and regulations that better suit your goals. For example, some choose to incorporate in Mauritius because of its (very) favourable tax laws 👀. Others choose Delaware because the laws surrounding employee stock options and syndicating investments are easy to navigate. Whatever the reason, the combination of laws and regulations a particular country has and how they are weighed by both founders and investors is amongst the most important flip factors.

3 reasons not to flip:

At this point you’re probably wondering who in your network can introduce you to the Raise team to help you get started on your flip. Firstly, I can 😉 ; secondly, and importantly, we should go over the cons of the process. All the better for making an informed choice.

Cost and Time 🕑

The cost of executing a flip is, frankly, quite high. This should come as no surprise considering the work that goes on behind the scenes. Whether it’s executing share transfers (and all of the corporate procedure that goes into that) or cleaning up unique issues like phantom shareholders - it takes a lot to get it right 😥.

It’s not cheap. In Kenya it will cost you around $6,000 and in Nigeria around $10,000 to a flip to Delaware.

That said, if it will give you access to close a a successful $500,000 deal round, it’s a necessary risk you’ll need to take. The real cost is how long it may take. All the time spent managing law firms in different jurisdictions amounts to time not spent making your next set of crucial hires or finding product market fit.

In this sense, despite the many virtues of a flip, it’s absolutely critical that you get the timing right. Misjudge the “when” and you might end up with cost overruns and wasted time; ultimately asking yourself - “why?.”

Cap Table Errors

Mistakes happen all of the time during a flip. This could create really expensive errors and issues down the line as the company grows. Most of those mistakes actually happen before and during the flip, because a company may have issued shares before the flip and then made even more mistakes during the actual transaction.

Tax Implications 😒

They say nothing is certain in life except death and taxes…well, these days even taxes are mired in uncertainty 😕.

You certainly have to pay them, that’s for sure. But what you end up paying for and when is where the confusion arises. Taking Nigeria as an example, the revenue authority applies different tax treatment for Nigerian shareholders and non-resident shareholders in an offshore holding company. The same goes for Kenya. In both nations, an offshore holding company may be subject to capital gains tax, despite the exit occurring overseas. Moreover, transfers of key contracts, intellectual property and employees (to name a few) may give rise to taxable events.

Summary

All of this is to say, ‘flipping’ your company will likely have tax implications and specialist tax advice should be sought before making that decision. This, of course, comes at a cost. However, weighed against the danger of incurring liability and falling foul of the tax man, it’s probably the safer bet.